Brief: DaVita’s investment in Elara

IKC just turned profitable. Now DaVita is funding new care models that push kidney care into the home, beyond the clinic.

It was a busy week in the DaVita newsroom. On Monday, the company announced its fourth quarter earnings for 2025 alongside news of its strategic investment in skilled home health leader Elara. In my mind, these headlines are important for two reasons: first, that home-based care continues to be the opportunity in front of us; and second, that profitability within value-based kidney care is possible. Both have important implications for where kidney care is headed, and whether that profitability can extend into the home in the years ahead.

Today I want to spend some time summarizing what we learned this week, better understanding the deal rationale based on what we know about dialysis footprints and economics, and anticipating where it leads next.

What happened

On the same day DaVita reported its Q4 2025 results, it also announced a strategic investment in Elara Caring alongside Ares (private equity), and the intent is clear: DaVita and Elara plan to co-develop a kidney-specific home-based care model designed to reduce preventable hospitalizations and lower total cost of care.

The announcement is careful about what it promises. It doesn’t claim a finished product or a national rollout. Instead, it frames this as a model-building effort that will combine Elara’s existing in-home clinical platform with DaVita’s kidney expertise, which is exactly what you would expect if the goal is to move from a strategic thesis (“home is the future”) to something operational (“here’s how we’ll do it”).

As a key focus of the investment, DaVita and Elara intend to co‑develop a kidney‑specific home‑based care model. This new model will build upon Elara’s existing clinical capabilities and apply DaVita’s advanced clinical insights to meet the unique needs of patients with kidney disease, seeking to reduce preventable hospitalizations, and helping to lower the total cost of care. The program will seek to offer patients a new pathway to receive high‑quality, tailored support in the comfort of their own homes, and empower providers with a vital resource to ensure high-touch, continuity of care.

Why Elara

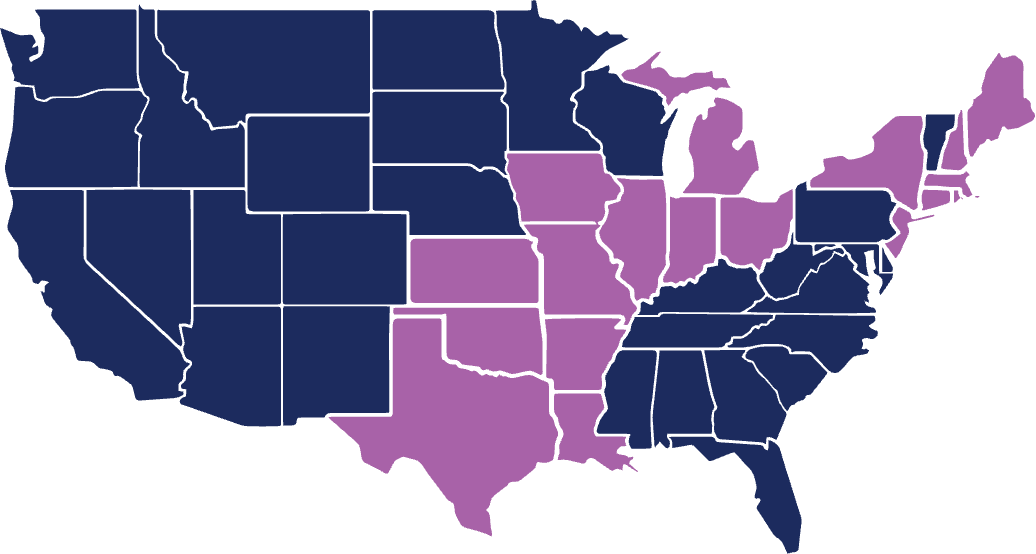

Elara’s scale is part of the rationale. The company describes a footprint across 18 states, supported by roughly 26,000 caregivers and 200 offices, serving over 60,000 patients and their families every day. If DaVita wants to expand its home footprint in a way that goes beyond home dialysis modality, it needs a platform that already knows how to staff, coordinate, and deliver care in the home for complex populations. Building that from scratch is possible, and DaVita has been growing home dialysis for years, but broader uptake has been slow, operationally heavy, and full of headwinds. Partnering may be faster and make financial sense, but only if the incentives, workflows, and accountability are designed to work together. That part takes time, capital, and know-how. Fortunately, this partnership brings all three.

The IKC operating layer

At the same time, DaVita’s latest earnings offer a useful lens on why this partnership is showing up now. IKC is the part of DaVita built for risk: it is designed to manage outcomes and total cost, not just deliver treatments. DaVita also signaled that IKC reached its first profitable year in 2025, with momentum improving in the back half of the year. That shift helps explain why “home-based care” might get a lift here.

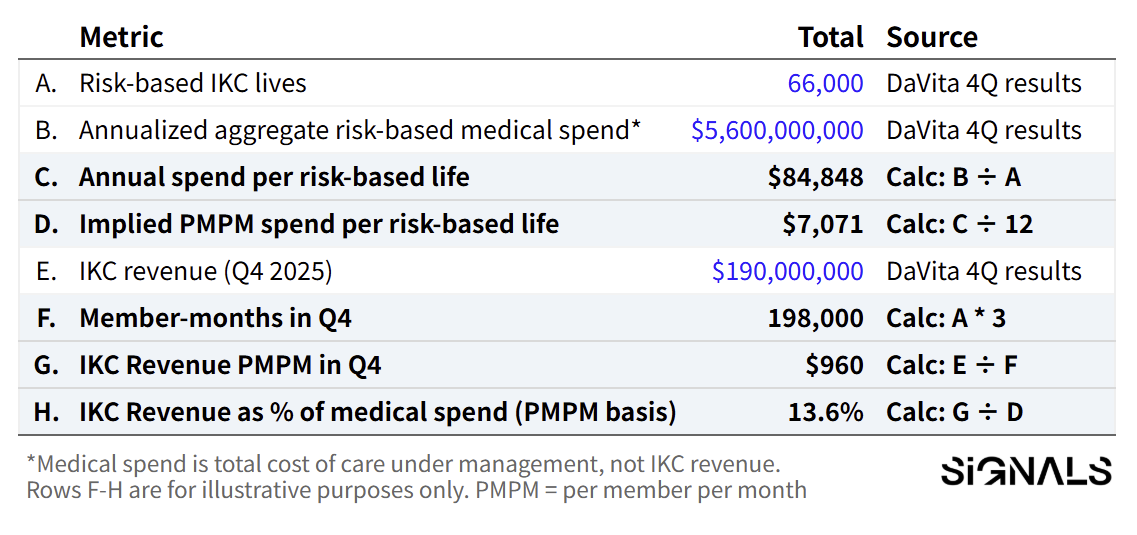

Table 1. IKC key metrics: implied PMPM spend and revenue1

The nuance I’m working through is that IKC can look small or big depending on where you’re standing. On the income statement, IKC is still a modest slice of DaVita’s overall business at ~$540 million, less than 5% of total company revenue. But it is moving. IKC revenue doubled quarter over quarter, rising from $94M in Q3 to $190M in Q4. On the patient side, it already touches a much more meaningful share of the population DaVita serves: 75,000+ lives across risk-based and other integrated care arrangements. Set against DaVita’s reported ~295,000 dialysis patients globally, that’s roughly ~26% of the company’s total patient base (with the caveat that these populations can overlap and aren’t perfectly comparable). In other words, IKC is still relatively small as a reported revenue line, while already sizable in terms of lives managed and strategic surface area.

That mismatch matters because the “bigger number” in IKC isn’t its revenue necessarily, it’s the spend it sits on top of. DaVita’s $5.6B in annualized medical spend is not money IKC books as revenue; it’s the total cost of care under management in its risk-based arrangements. That’s the growing pool of at-risk capital that an at-home model could influence, and it’s what makes investments in wraparound home support investable in a way fee-for-service rarely sustains.

Author’s note: For more context on the current landscape and economics of risk-based kidney care, see our recent series here.

How it works

What remains unclear, and what I think will define whether this becomes a meaningful new leg of DaVita’s business, is the operating model. The announcement is light on details. For example, whether DaVita will enroll its IKC kidney patients into Elara-delivered home services, whether Elara’s existing patients include a meaningful kidney cohort that DaVita will wrap with kidney-specific programs, or whether the first version is a jointly managed population that starts narrow in a few markets and expands where it’s needed.

It’s also not yet clear how the investment capital will be deployed in practice: whether it supports workforce buildout, technology and coordination infrastructure, payer contracting and risk-sharing mechanics, or a mix of all three. Those are not small details, but they are certainly top of mind for other value-based entities operating home-based care models in this space.

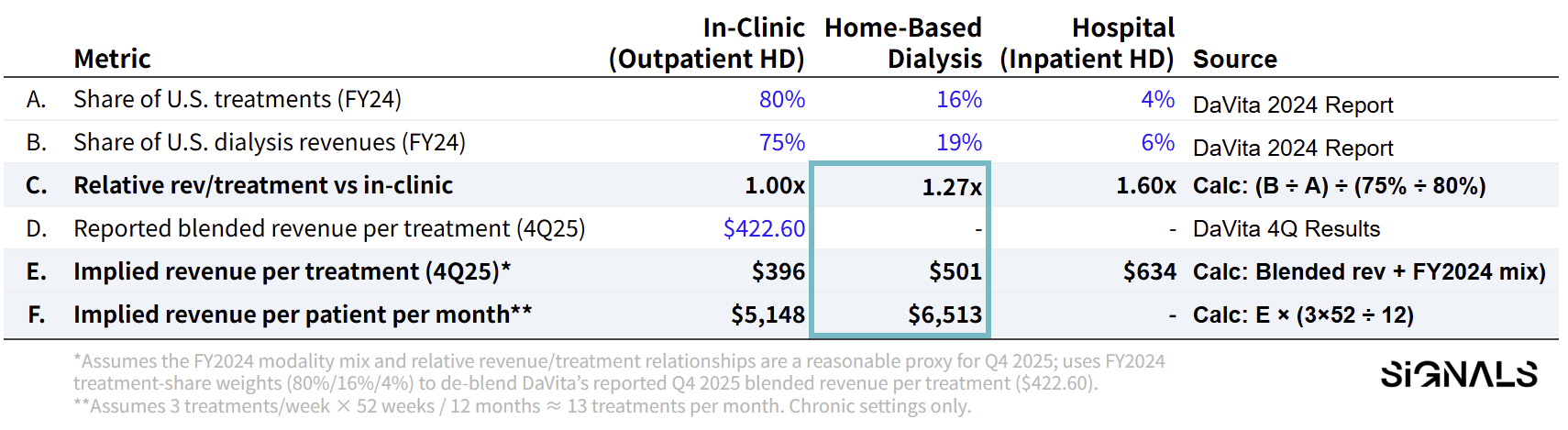

This is a DaVita-specific lens. We’re applying its 2024 setting-level revenue mix to its 2025 blended revenue to estimate an implied split by setting (in-center, home, vs. hospital). It’s not a universal model for home dialysis economics. Smaller home-first providers will have different overhead, staffing ratios, supply costs, and referral dynamics. Some advantages, some challenges.

Table 2. Implied Dialysis Revenue Mix

Assumptions

The key clue in DaVita’s prior reporting is simple: home dialysis is a smaller share of treatments, but a bigger share of dialysis revenue. In 2024, home was ~16% of treatments and ~19% of dialysis patient service revenues. That implies home treatments are about 27% more revenue-dense than in-center treatments.

If we apply that same relationship to DaVita’s reported Q4 2025 blended revenue per treatment ($422.60), we can back into a rough split: ~$396 per in-center treatment vs. ~$501 per home treatment. It’s directional, not precise. Mix changes year to year. But it helps explain why DaVita keeps leaning into “home” even when modality share moves slowly. Home doesn’t need to become the majority to matter. It just needs to scale enough to shift incentives, staffing, and how care gets delivered.

Closing

Mozarc is worth recalling here because it shows DaVita’s long arc. In 2022, DaVita and Medtronic announced Mozarc as a 50/50 kidney technology venture, funded with $200 million each, built around the idea that at-home innovation would require both devices and care delivery know-how. I imagine the Elara partnership reads like the next iteration of that same ambition; less about inventing a new machine, and more about building the operating layer that actually makes home-based kidney care work.

Still, the direction of travel is visible. DaVita is effectively saying that the next home footprint in kidney care will not be measured by modality mix or machine. It will be measured by whether coordinated care can reach patients where they live, keep them stable, and do it in a way that is economically durable under risk. Dialysis economics still pay the bills, but IKC becomes a lever that funds the operating layer around the patient beyond the outpatient network. The Elara partnership is a bet on the care integrations required to do that. IKC’s performance is the early evidence that the economic layer may finally be catching up.

I’d love to hear what you think. Leave a comment below and let us know what questions we should be asking or where you think this leads next.

My sincere thanks to Zach Miller for his business of ESRD series over at The Post-Op, which helped shape how I organized this brief and framed the calculations and assumptions used in the tables. His 7-part series from 2022 is a masterclass, go check it out.

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)

Great brief, Tim. What stands out to me is the strategic logic of strengthening care delivery in the home for people living with kidney disease. Supporting dialysis patients through home-based clinical services (that already exist) makes sense as it aligns care with how patients live, improves continuity, and reduces friction across the care journey. There are meaningful long-term synergies here. A strong home health platform creates optionality to support home dialysis and other kidney care services over time, as unanswered questions around integration, workflow, and patient experience become clearer. This is a space worth watching closely. The opportunity to deliver added value to dialysis patients through thoughtful, home-centered support is real, and investments like this signal clear intent around where kidney care is heading.

Agreed Tim. Our kidney care industry's desire and best efforts are not working. Edicts from the administration are not working. I think collaborating with the people who are successfully providing home care, especially with such a broad footprint and now with resources, is a reasonable way to potentially develop a working blueprint and move the needle.