The Current Landscape of Value-Based Kidney Care, Part 2

Business and Financial Performance Across 10 Kidney VBC Models

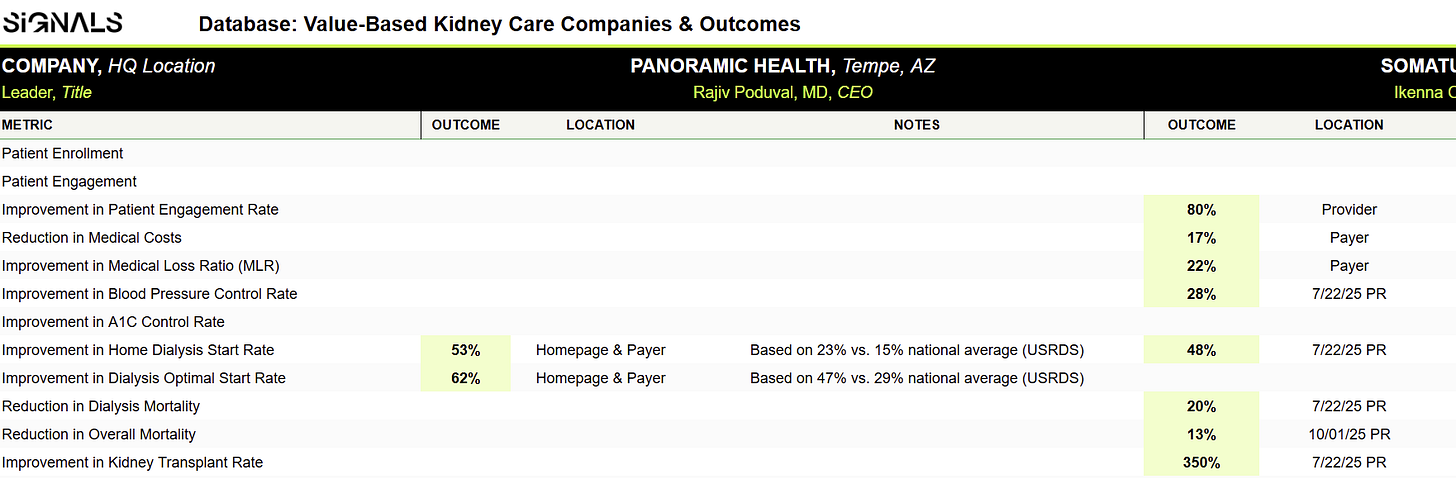

Last month we shared the first installment of Signal’s research initiative focused on value-based care (VBC) in kidney disease. We led with outcomes before stepping back to examine the underlying business models and growth drivers of the major VBC providers. This was intentional, to spotlight the real and meaningful impacts these organizations are having on patients and the broader healthcare system.

In this second part of the series, we cover the key players who are driving the growth in VBC and their headline business metrics, including:

The number of patients they serve

The amount of healthcare spend they manage

How much capital they’ve raised

What diseases and patient conditions they focus on

Whether they participate in KCC model

How many providers / clinicians they work with

What geographies they cover

Admittedly, some of the data we shared on this topic in the intro to last month’s piece was in need of a substantive update, and that’s a good thing, since it shows the real progress the VBCs have made in driving their business forward in the last year, if not the last month. And just a reminder as we dive into the latest figures that the insights we are sharing are from a comprehensive database of publicly available information that Signals is building to track the business models, product offerings, and outcomes of VBCs. We share more about this research initiative at the end of the article.

Summary of Key Business Metrics

Our latest updates to the key business metrics of the leading VBC providers are shown in the table below:

Compared with data Signals has aggregated over the past few years, estimated managed spend has increased most significantly, roughly doubling since our last update. And the current figure may be an understatement as some large providers like Monogram do not make this number publicly available, and others like Panoramic have not published recent updates. So, while it’s encouraging to see managed spend approaching $40B or about 20% of all FFS Medicare spend on CKD/ESRD, it would be beneficial to to understand if the lack of complete spend growth data is due to typical business sensitivities or other factors.1

Providers are much more transparent and up-to-date with sharing information about the number of patient lives they cover. The current figure of 1.5M+ represents a nearly 50% increase from our last update. Somatus alone accounts for half of that growth, but Panoramic and others have grown as well over the last few years. Interwell has also shown 10k - 20k per year increases in patient counts, but its currently published figure of 145k is still shy of the ambitious 270k target it set for 2025 when it announced the merger with Cricket and Fresenius in 2022.2 In fairness to the providers, they almost always indicate that their patient counts and other metrics are “+” or greater than the published figure, and certainly there’s lag time for internal data aggregation, website updates, etc.

Another important caveat to the patient lives data is that it now likely incorporates non-kidney patients. In fact, the top 3 VBCs who account for about two-thirds (1M+) of the total number of patients served are the ones who have most aggressively expanded their services into other diseases and conditions. Monogram in particular has been addressing multiple chronic conditions since 2020, and both Panoramic and Somatus highlight their ability to manage congestive heart failure.3 And of course, all VBCs are interested in avoiding hospitalizations regardless of cause, but it’s becoming more clear that the stand-alone nephrology VBCs in particular are increasingly broadening their capabilities.

Our database also captures information about the location and number of providers the leading VBCs support, including the following:

403+ practices, or ~38% of total (1,061)4

7,500+ specialists, including nephrologists

30,700+ providers / clinicians of all types supporting patients

At least 4 VBCs covering all 50 states, with the average VBC covering 34

We can also cross reference these provider figures with the latest CMS data to glean that 7 of the 10 leading VBCs are participating in the latest KCC model year (Panoramic, Monogram, and Healthmap are the exceptions). Among the KCC participants, 4 also independently share their total number of practice relationships, and we can derive that only about 10% of the practices in our sample participate in KCC.

Also, from the total managed spend and patient lives data, we can estimate managed spend per patient. For the 7 providers that provided contemporaneous figures for both managed spend and patient lives (some of which are different and older than the data shown in the table above), their spend per patient ranged from $15k to $75k, with an average of $33k. DaVita IKC and Kidneylink anchored the high-end of the range, likely given their origins in and focus on late stage kidney patients transitions to or on dialysis.

Last, we captured and updated available funding and financial data from VBCs. Information in this area is limited given that the companies are privately held or subsidiaries. The most notable event in this area is Strive’s $550M equity and debt raise this past September which could be viewed as another vote of confidence among both the financial and strategic investment communities for VBC models. The following snippet from Strive’s press release regarding how the new investment will be used to “...grow its multi-specialty services and enhance its value-based care model through advanced technology, including AI-driven tools and analytics…” best captures the growth opportunity for the industry…expanding outside of kidney disease and integrating advanced technology with existing, patient-facing provider relationships.

Conclusions & Next Steps

While VBC business models for kidney disease have been around for 2 decades, it’s impressive to see the acceleration in growth over the last 5 years. About one third of kidney disease patients are now cared for in VBC programs, and, as shown in our review of outcomes last month, patients and the healthcare system as a whole are benefiting from these arrangements. But the care model is beginning to evolve beyond kidney disease, and that’s a good thing since patients often have comorbidities whose treatment benefits from a holistic approach. In our next installment we will review some of the approaches and technologies that the VBCs are using to manage patient care, for kidney disease and beyond.

We are also on a journey to compile a fact-based, analytical view of the evolution of the industry, and Signals’ database now contains over 300 published and derived data points with accompanying sources and notes. As noted in part one, while these data are almost entirely sourced from the providers themselves, we are working to confirm, refine, and normalize them to provide a common framework for how to view the growth and impact of the industry. If you would like to learn more about our database please fill out this form and/or contact paul@signalsfs.com and tim@signalsfs.com.

Upcoming Signals research on VBCs will focus on product offerings (e.g., analytics, AI, patient facing resources, provider tools). Click the image below to see outcomes data from Part 1, and stay tuned for Part 3.

___

About Us

Paul Grill is the Co-Lead of Signals Advisory and a career management consultant, M&A advisor, and venture investor. His most recent role was as Launch Director for the National Kidney Foundation’s Innovation Fund, where he led investments in startups bringing new treatments to kidney patients. Paul is also a living kidney donor and former NKF Board Member who is passionate about improving the lives of kidney patients.

Tim Fitzpatrick is the founder of Signals Group, a media and research platform exploring innovation, investment, and ideas shaping the future of kidney health. Through Signals, he has helped connect thousands of clinicians, entrepreneurs, and investors driving progress across kidney care. Tim previously co-founded IKONA, a learning company using immersive technology to improve patient education and frontline training in kidney care.

Together, Paul and Tim combine deep industry, investment, and advisory experience. From market research and landscape analysis to investment support, financial modeling, and expert feedback, they deliver insights that help companies make confident decisions and accelerate impact in kidney care. Learn more at signalsfs.com

2023 SNP Alliance Policy Roundtable: Bringing Modernized Kidney Care Home (Monogram Health, snpalliance.org)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)