Signals Brief: Spend Now to Save Later? What We Know About The KCC Model’s Cost Curve and Future Direction

The latest results show major progress on outcomes—and a growing tension between near-term investment and future impact as PY26 changes reshape incentives

TL;DR

New data shows the KCC Model is producing strong clinical outcomes—but the financial payoff hasn’t arrived yet. New policy changes coming in PY26 have altered the math for participants. Time will tell how they respond. This brief breaks down what’s changed, what’s working, and what’s still to come.

What Happened

CMS released summary results from the Kidney Care Choices (KCC) Model’s second performance year (PY2023), and the data tells a story of clear clinical momentum—but rising financial pressure. Providers participating in the model made measurable gains on nearly every front: optimal dialysis starts rose 31%, home dialysis use increased 10%, and preemptive kidney transplants jumped by an eye-catching 69%. Living donor transplants also rose by 22%, and preemptive waitlisting—often a precursor to better outcomes—increased by 40%.1

But the progress came with a price. Total net Medicare spending increased by more than $300 million in 2023, driven in large part by incentive payments—like transplant bonuses and capitation for CKD care coordination—that are core to the model’s design. CMS didn’t find statistically significant increases in Parts A and B service costs alone. Rather, the increase came from adding in model-specific investments meant to change how kidney care is delivered and rewarded. Again, as designed.

In short: the KCC Model is working as intended—but it’s “expensive.” And with new policy changes coming in 2026, the tension between spending today and saving tomorrow is playing out in ways we’ve long described but rarely seen so clearly. The question is: Are we prepared to follow through and accept the cost of transformation? Will an additional year of CKCC be enough to show policy makers the return on investment it’s after when it comes to addressing chronic illness?

“The KCC Model led to statistically significant changes in quality, utilization, and payments across the disease life cycle relative to pre-KCC rates.”

Why It Matters

The KCC Model wasn’t designed to cut costs overnight. It was designed to realign incentives: to reward earlier, better, and more coordinated care. And like any shift of this scale, it comes with a price tag. The incentive payments driving this year’s spending increase—transplant bonuses, capitation for CKD care, and shared savings—are not excess. They are the mechanism. They represent a deliberate bet that upfront investment—both financial and operational—can produce long-term value through fewer emergency dialysis starts, more transplants, and better patient outcomes.

That investment doesn’t live on paper. It lives in the daily work of providers who’ve taken on new responsibilities, often without the systems or staff they need. Nephrology practices participating in the KCC Model have built new modality education workflows, hired transplant coordinators, and expanded outreach to patients long before they ever reach a dialysis clinic. And in many cases, it’s private practice nephrologists leading the way.

As Katie Kwon and I wrote in Kidney News, “Nephrology has become a laboratory of sorts for alternative payment models… The business sense and nimbleness of private practice nephrology are assets to the specialty and to the medical system as a whole; if we cannot make something work, it is unlikely to succeed at scale.” But that flexibility has its limits. Medicare compensation has declined 29% since 2001 (adjusted for inflation), and many private groups are stretched thin. Asking them to deliver coordinated, multidisciplinary care while absorbing financial risk is a high bar—even with bonuses.

One nephrologist put it plainly:

VBC is resource intensive. Although only 33% of our patients are aligned with our current model, we have hired kidney care coordinators and expanded our educational and outreach programming to address the needs, depending on risk factors, of 100% of our patients. The revenue we earn back from participating in the Kidney Contracting Entity (KCE) in the form of quality incentives, the Advanced Alternative Payment Model (or AAPM) bonus, and shared savings helps subsidize the cost of this care for our patients who are not KCE-aligned.2

That’s the paradox at the heart of the model: the incentives work—but only when providers are resourced to meet the moment. And with key incentives set to change in 2026, the future of that support is uncertain.

What’s Changing in PY26

CMS has announced several updates to the Kidney Care Choices Model that will take effect in Performance Year 2026. While the program itself will continue—and CKCC will be extended through 2027—the financial mechanics are changing in ways that many consider significant. Candidly, I hope this piece helps open a dialogue around how these changes might impact participants of all types and sizes in the years ahead.

Here’s a snapshot of those updates:

Among the most notable changes:

Capitated payments for CKD care (QCP) will be reduced by 50%, even as care coordination remains a central goal of the model.

The $15,000 transplant bonus, previously paid out over three years per transplant, will be eliminated.

Benchmark discounts of 1% will be added for both CKD and ESRD populations, effectively lowering the ceiling on potential shared savings.

The Kidney Care First track will end one year early, while CKCC options will be extended through 2027, consolidating participation under one track.3

Some see these changes as expected course corrections to control spending. Others view them as potentially disruptive—especially for smaller or newer participants who are still scaling their operations (see comments above). Larger organizations that have fully committed to the model may be better positioned to adapt. What’s clear: These changes reshape the economics of participation, and reactions will likely vary by size, structure, and risk appetite.

It’s also worth noting what isn’t yet clear. The public evaluation offers limited detail on which incentives drove the $304.8 million in added Medicare spending. Without that detail, it’s difficult to assess the net policy value—or the longer-term consequences of pulling back incentives just as outcome trends are improving.

The good news: the program continues. The extension of CKCC gives current participants more time to realize the benefits of their early investments (albeit not as much time as they perhaps would have liked). But the questions going forward are big ones—and we do hope this brief offers a starting point for those conversations.

The Bigger Picture

The story of KCC is still being written. Providers are playing their part—but they’re not writing the script. Still, this model is one of the most ambitious value-based payment models CMS has launched to date—and like many of the Innovation Center’s earlier experiments, it’s being actively reshaped in response to early data and feedback.

In a January 2025 Health Affairs essay, CMMI leaders outlined their evolving approach to model innovation. Success, they argued, doesn’t always come from getting everything right at launch. It comes from learning, adapting, and designing successor models that can carry forward what works—and leave behind what doesn’t. “Most models require active management and modification to become successful,” they wrote. “Successor models build on what came before—not just in structure, but in timing and strategy.”

KCC fits squarely into that vision. It builds on lessons from the earlier ESRD-focused CEC Model, expands the scope to include advanced CKD and transplant recipients, and gives nephrology providers new tools to manage population health in ways the traditional Medicare program rarely supports.

But like any model that blends clinical innovation with financial risk, KCC faces a dual challenge: showing results quickly enough to satisfy policymakers, while giving participants enough time and stability to realize the full return on their investments. That’s the balance CMS seems to be after with the PY26 changes—and it’s where much of the tension lies.

For now, the core idea remains intact: reward what matters, support what works, and let the data guide what comes next.

What’s Next

More detail is coming—and it will matter. While the topline results offer a glimpse of progress, individual provider-level data will be critical to understanding what’s really working, where variation exists, and how different approaches are translating to outcomes and cost performance.

Meanwhile, the next phase of CMS kidney innovation is starting to take shape. The forthcoming Increasing Organ Transplant Access (IOTA) Model may absorb some of the goals previously supported by KCC transplant incentives. And future iterations of value-based kidney care—whether successor models, regional pilots, or something else entirely—will likely be informed by the KCC data and the community’s response to these 2026 changes.

For now, providers remain in the model. CKCC has been extended, and early outcome trends are encouraging. But as the policy shifts take effect, all eyes will be on what happens next: who stays in, what changes on the ground, and how CMS interprets the signals from this next round of data.

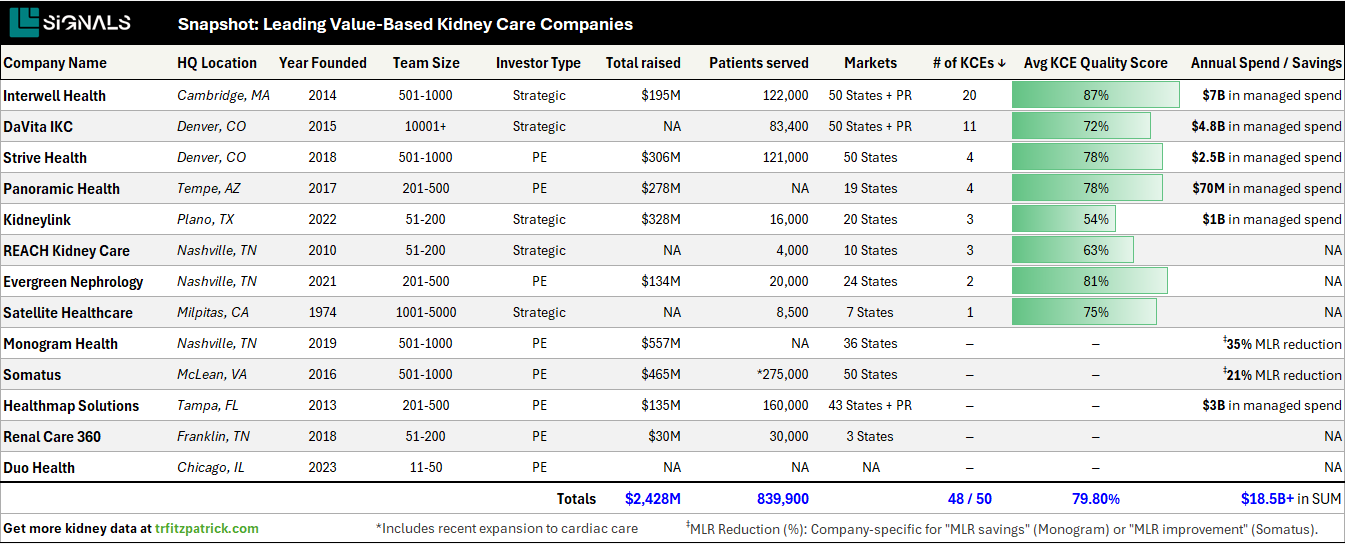

We will continue listening, learning, and sharing what we find out as things progress. When individual provider-level data is released (hopefully soon), we will summarize, synthesize, and publish our findings. In case you missed it, we also published our summary of Year 1 results and the VBKC Directory earlier this year as part of that ongoing effort.

One day at a time. Keep exploring,

This brief is meant to inform—and to invite conversation. The upcoming changes to the KCC Model are substantial, and their impact will likely vary depending on your role, organization, and experience within the program. We’d love to hear how you’re thinking about what’s ahead. Please share your thoughts below or join us in Slack to keep learning.

Discussion

Can CMS afford to scale back incentives just as outcomes begin to improve?

What happens to transplant growth once the bonus disappears?

What will happen to kidney care coordinators once KCE subsidization ends?

What role should Medicare Advantage play as federal APMs shift?

What can we learn from high-performing KCEs, and how should those lessons shape future models?

KCC Model Evaluation (PY23): This report summarizes findings from the evaluation of the Kidney Care Choices (KCC) Model in 2023, the model’s second performance year (cms.gov)

From Volume to Value: Nephrology's Tough Transition: “Our nephrology practice has been involved in Medicare value-based care (VBC) models since 2017. We were drawn to the alignment of higher quality care with shared savings incentives. Despite our successes, we find the programs difficult to navigate due to year over year changes in quality metrics, delayed data reporting, surprises in the shared savings waterfall (i.e., the retrospective trend adjustment and normalization factor), as well as overall program complexity...”

KCC Participant Lists and Affiliations (PY24): Notice of CMS Kidney Care First Practices and Kidney Care Entities Participating in Performance Year 2024 of the of the Kidney Care Choices (KCC) Model (cms.gov)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)