The Current Landscape of Value-Based Kidney Care, Part 3

Product, Technology, and Care Model Capabilities Across 10 Kidney VBC Models

As we make our way through January, Signals is publishing the third installment of our value-based care (VBC) research initiative in as many months. This piece completes the initial phase of our analysis, which is grounded in a growing research database now spanning more than 500 data points and calculations. While this database will continue to evolve alongside the industry, we believe it captures a clear and current picture of how value-based kidney care models are being deployed, scaled, and positioned today.

Recall that in Part 1 of our series we highlighted some of the early, but impactful data that VBCs are sharing. These included increases in dialysis optimal start rates ranging from 62% to 400% and reductions in hospitalizations between 20% and 50%. Part 2 focused on the growth of and investment in VBC models and how they are collected managing about 1.5 million patients and $40 billion in spend while expanding beyond kidney disease.

In Part 3 below, we highlight the approaches and technologies VBCs are using to drive both their own growth and outcomes for patients. While we have collected over 150 new data points in the last few weeks, the analysis below is less about specific numbers and more about highlighting the combination of capabilities VBCs are deploying in the following areas:

Patient Support: the suite of services and supports that VBCs offer to patients to help them optimize their outcomes through the stages of kidney disease.

Provider Enablement: how VBCs both enable nephrologists, PCPs and other providers deliver care to patients as well as help them optimize their own practices.

Technology (both patient and provider oriented): the products and technologies that can be implemented to engage with patients, support clinical decisions, and improve practice operations.

These three categories of capabilities are being used in concert by VBCs to delay disease progression, increase optimal starts, reduce hospitalizations and total cost of care for patients with advanced kidney disease and related comorbidities. However, both the depth and breadth of capabilities varies significantly across the industry, and, as we describe at the end of this article, is dependent on the business model of each competitor.

Patient Support

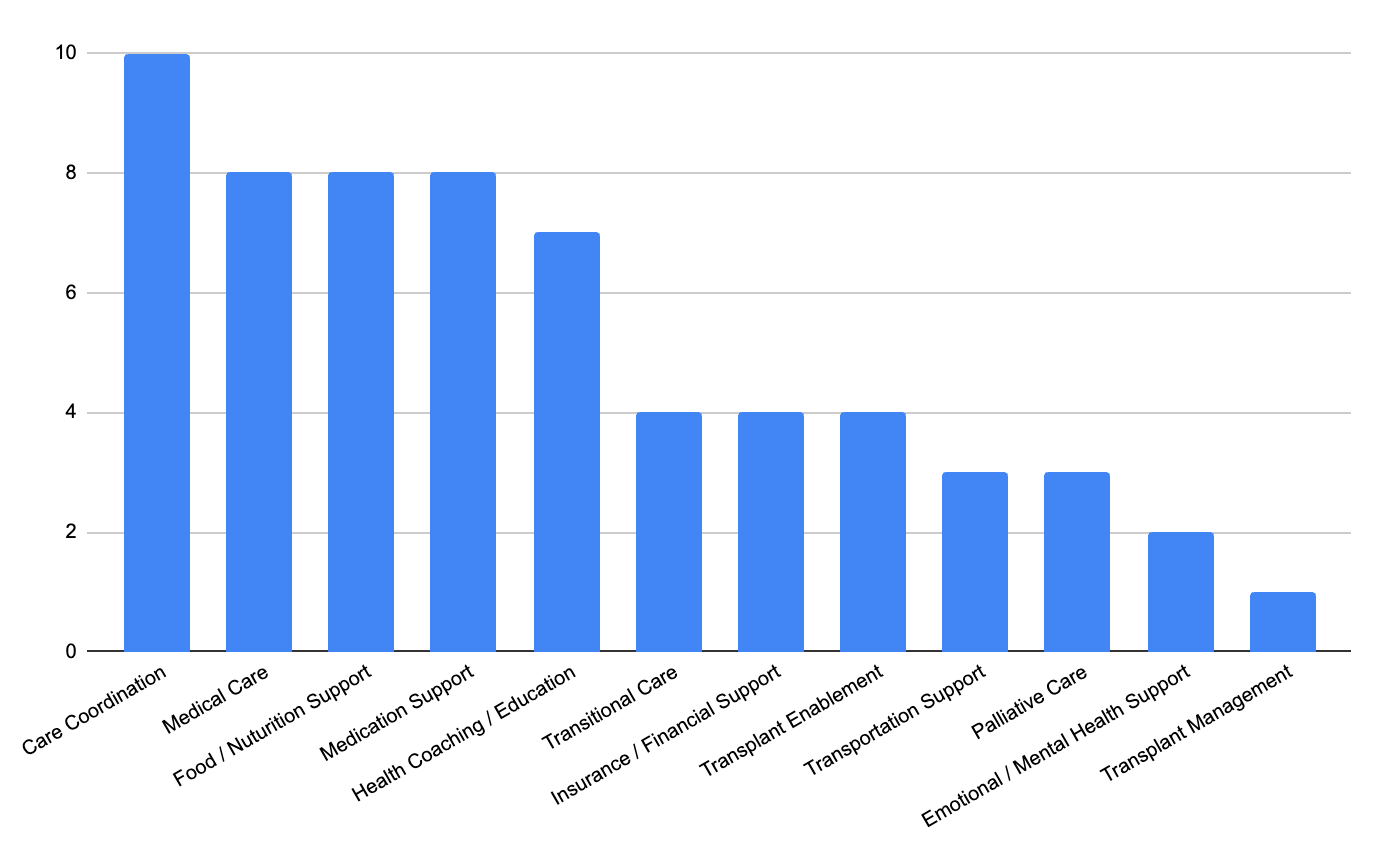

As shown in the chart below, the hallmark of the VBC business model is Care Coordination: creating an individualized care plan, enabling access to a multidisciplinary care team, and helping to ensure compliance with appointments and adherence to those treatment plans. Every VBC provides a version of this and many also specifically call out their ability to coordinate care with patients’ physicians who are outside of the VBC relationship.

Figure. Number of Leading VBCs Offering Selected Patient Support Services

Across leading kidney VBCs, dedicated teams provide structured medical care, medication management, nutrition, and social support designed to address both chronic disease management and acute care needs outside of traditional visits. These teams are typically physician- or NP-led and interdisciplinary, combining nursing, care coordination, pharmacy, nutrition, and social work to function as an extension of the nephrologist across settings including PCP and nephrology offices, hospitals, and patients’ homes. Strive Health refers to this model as its “Kidney Heroes,” emphasizing deep patient engagement, but similar care team configurations and patient-facing support models are now standard across most scaled kidney VBC platforms.

Moving to the center and right side of the chart, we identified a handful of VBCs offering specialized services to help patients with kidney failure (ESKD) transition out of the hospital (and avoid being re-admitted), pursue transplantation as an alternative to dialysis, and address the day-to-day challenges of being a patient with ESKD. Most of the VBCs likely offer these or similar services, but it has not yet been a priority to highlight them in their public or patient facing materials, so the bars likely underrepresent capabilities. Notably, though, even REACH, one of the smaller VBCs included in our analysis in terms of team size and lives served, highlighted its ability to help patients who receive a new kidney to sustain their transplant over time.

Provider Enablement

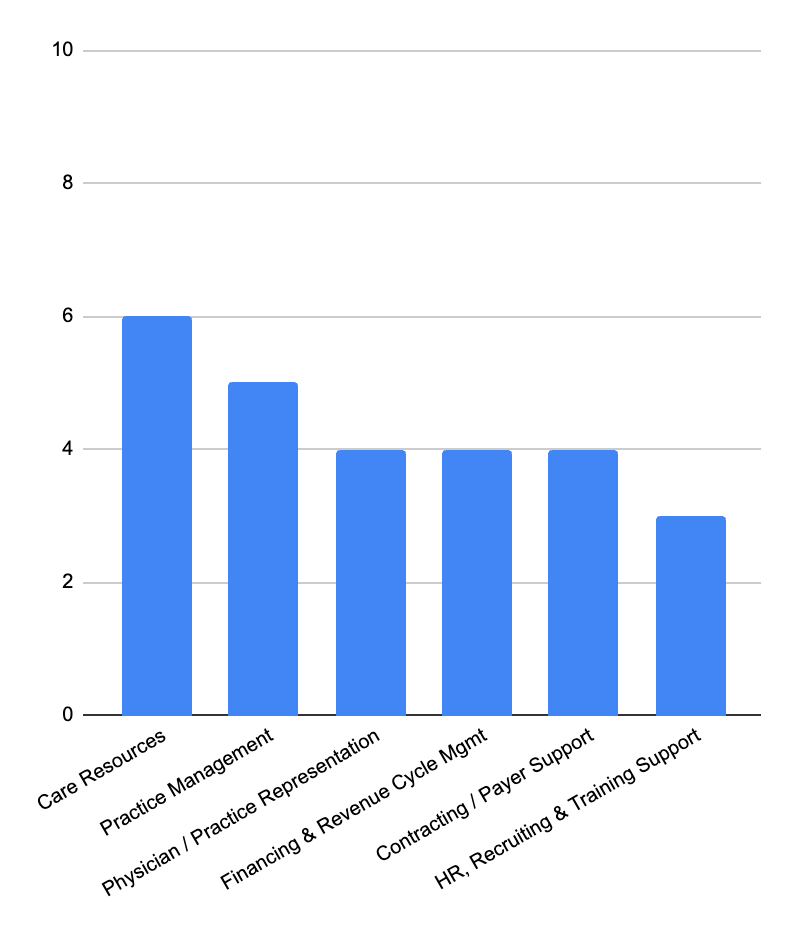

Fewer of the VBCs highlight their ability to enable providers relative to supporting patients, but this should not be interpreted as an indication that services provided for physicians and their practices are relatively less important. Rather, it’s likely that the B2B aspect of their business models are not as prominently displayed, and require more nuance to convey than, say, being able to offer kidney-friendly recipes to patients.

Figure. Number of Leading VBCs Offering Selected Provider Enablement Services

That being said, the majority of the VBCs do offer care resources as extensions of physician care teams to help deliver care coordination, medical support, and other of the key services described above to patients. In many cases, these are “boots on the ground” resources in local markets. Somatus, Monogram, and Strive Health in particular highlight how their clinicians can act as physical and in-home extensions of practices by, for example ‘visit[ing] your patients in their homes, serving as your “eyes and ears”’ as highlighted by Monogram. Interwell and Kidneylink even discuss their ability to embed themselves in practices.1

Aside from augmenting staff, several of the VBCs focus on how they can help their partner practices optimize their business and drive growth. Sometimes these services are offered in the form of an upfront business assessment, but often VBCs can deploy a suite of ongoing support services and technologies (discussed in the next section) to help streamline back office functions, train staff, optimize contracts, and even provide financing. Panoramic, Interwell and DaVita highlighted the greatest set of capabilities in these areas, although the latter likely reflects overlaps with dialysis clinic operations and management.

The VBCs who offer these provider enablement services typically frame them as a way for physicians to focus on patients and alleviate the burdens of day-to-day operations without giving up control of either their practice or patient care. To that end, it’s common for VBCs to also highlight how participating physicians can play a role in the overall VBC care delivery model through, for example, Panoramic’s Physician Executive Body (PEB).

Technology (Patient & Provider)

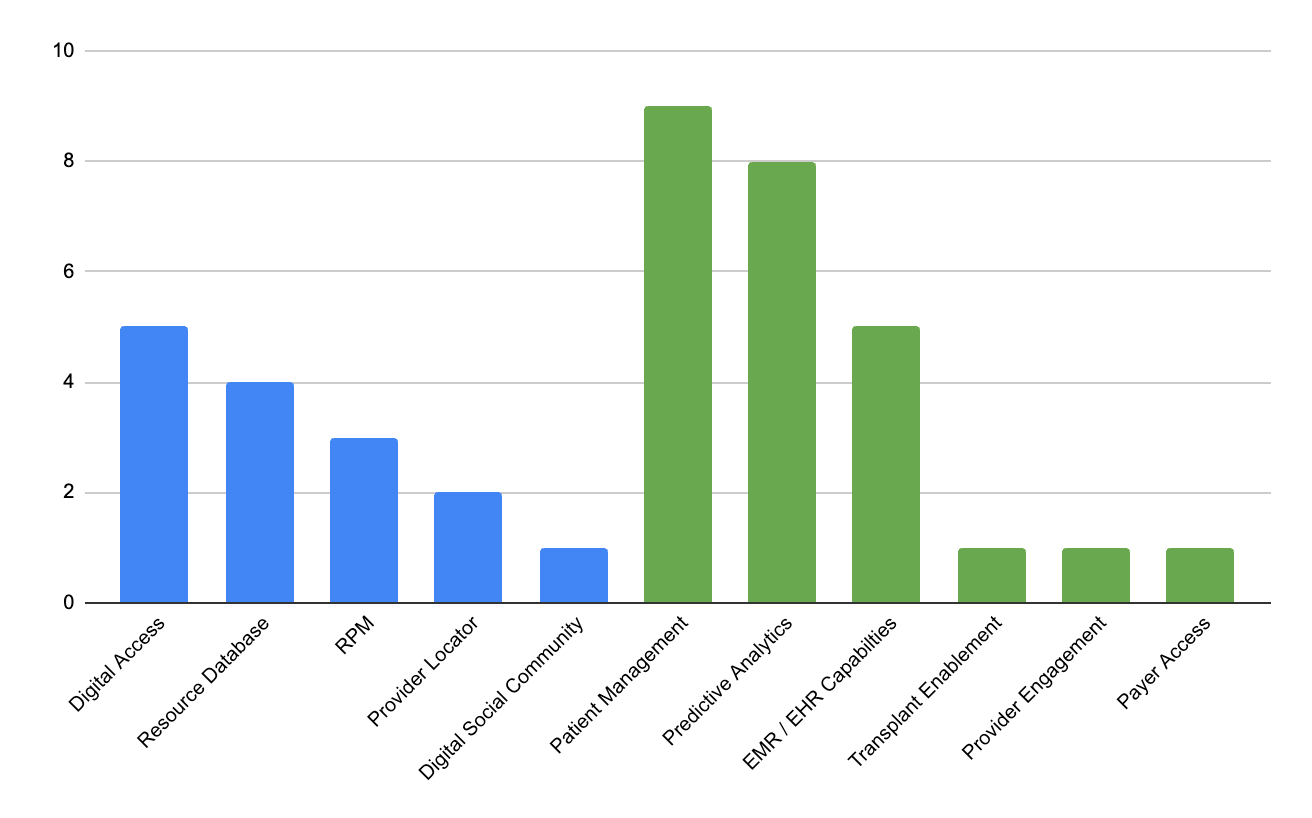

While technology is integral to both supporting patients and enabling providers, one headline takeaway from the chart below is the relatively greater deployment of key systems and platforms to help physicians care for patients versus patients directly leveraging technology. While it’s encouraging that at least half of the VBCs do have a digital (online or app-based) interface for patients, care delivery is still heavily focused on meeting kidney patients where they are, which is often in-practice, in-home, or via phone / telehealth, rather than with a sophisticated technology platform.

Figure. Number of Leading VBCs Offering Selected Technologies to Patients (Blue) and Providers (Green)

In addition to digital interfaces, VBCs like Interwell, Healthmap, and DaVita utilize their patient-facing websites to deliver extensive patient education materials to patients. Interwell Learning, formerly Raenali, offers providers a reimbursable kidney disease education (KDE) option that includes one-on-one sessions with clinical educators.2 Healthmap’s proprietary Compass platform and recent acquisition of Carium give providers end-to-end kidney population management capabilities. Meanwhile, the mySomatus app offers an online social community for patients, and is just one of five core product elements from its broader RenalIQ platform. A handful of companies suggest that they offer remote patient monitoring (RPM), yet the specifics of these solutions are not described and monitoring the key indicators of kidney disease typically requires lab tests. Of the three VBCs that indicate RPM offerings, Panoramic’s and Monogram’s may reflect their expansion into heart failure and other chronic diseases.

In terms of provider enablement, virtually every VBC highlights two key features of their technology. First, is their patient management platform, which enables the core care delivery capabilities of VBCs that we highlighted in the beginning of this article. These systems help both partner physicians and VBC care teams identify what interventions patients require, when they are needed, and who should deliver them.

Complementing (and often integrating with) these patient management systems are predictive analytics technologies that leverage patient data to identify and analyze the risk of patients progressing through stages of CKD or needing interventions to prevent hospitalizations in the ESKD population. Predictive analytics can also be used from population health perspective and on the “front-end” of a payor or provider relationship to understand the extent of a patient community that may benefit from a value-based care model. Notably, six of the eight competitors indicated that their analytics capabilities were AI or ML driven.

At least half of the VBCs offer electronic health and medical record (EMR / EHR) platforms or the ability to integrate their systems with existing EMRs. DaVita highlights a customized version of Epic, Interwell integrates with Epic via its Acumen platform that it acquired from Fresenius in 2022, while others like Monogram and Strive offer a purpose-built platform combining care management and EHR functionality.

VBC Capabilities Summary

Our research so far highlights the importance most VBCs place on directly supporting patients, enabling providers, and leveraging technology, primarily to maximize the effectiveness of patient touchpoints. The heatmap below distills the data in different way that hints at how various competitors are shaping their offerings to support their business models: Panoramic focused on practice enablement, Somatus both patient and provider oriented, Interwell and DaVita with extensive business optimization from their roots in clinic management while also being experienced in supporting ESKD patients, Healthmap emphasizing its technology, and Strive with its patient forward Kidney Heroes model.

Figure. VBC Capabilities Heatmap

That said, this capabilities review should be interpreted as an initial, high-level perspective on how the VBCs present themselves to patients, providers, and payors via their public facing websites, press releases, and similar materials. Some of the boxes in this heatmap are likely darker in reality, and very light boxes should be viewed more as a “TBD” than an absence of functionality. Signals continues to dig into capabilities, growth, outcomes, strategies, and financial performance of the VBCs to update our database and periodically share the important progress these companies are making on improving the lives of kidney patients.

Series Conclusion & Next Steps

Across this three-part series, we examined value-based kidney care from outcomes, scale, and capabilities. Taken together, the data show that kidney VBC has moved from pilot-stage experimentation to a more mature, concentrated, multi-billion-dollar segment managing meaningful clinical risk at scale. As we pointed out in Part 2, a small number of platforms now sit at the center of this ecosystem, differentiated less by the mechanics of value-based care and more by how they contract, deliver care, and deploy technology to augment their capabilities.

Underlying this work is a Signals research database designed to support those building, growing, and partnering with value-based kidney care organizations. The database aggregates publicly disclosed and derived data across outcomes, lives managed, financial scale, care models, and product capabilities, with the goal of providing a clearer and more consistent view of how this market is evolving.

We are making this database available to select operators, payers, investors, and partners who are actively working in or adjacent to kidney value-based care and are looking to better understand the competitive landscape, operating models, and areas of differentiation. We plan to update the database regularly as the kidney VBC market continues to evolve.

If you’re interested in learning more about the database or discussing how it may be relevant for your work, please complete the form below.

___

About Us

Paul Grill is the Co-Lead of Signals Advisory and a career management consultant, M&A advisor, and venture investor. His most recent role was as Launch Director for the National Kidney Foundation’s Innovation Fund, where he led investments in startups bringing new treatments to kidney patients. Paul is also a living kidney donor and former NKF Board Member who is passionate about improving the lives of kidney patients.

Tim Fitzpatrick is the founder of Signals Group, a media and research platform exploring innovation, investment, and ideas shaping the future of kidney health. Through Signals, he has helped connect thousands of clinicians, entrepreneurs, and investors driving progress across kidney care. Tim previously co-founded IKONA, a learning company using immersive technology to improve patient education and frontline training in kidney care.

Together, Paul and Tim combine deep industry, investment, and advisory experience. From market research and landscape analysis to investment support, financial modeling, and expert feedback, they deliver insights that help companies make confident decisions and accelerate impact in kidney care. Learn more at signalsfs.com

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)