The Current Landscape of Value-Based Kidney Care, Part 1

A review of publicly reported clinical, operational, and cost outcomes from 7 leading nephrology VBC providers

Value-based care (VBC) for kidney disease has been an evolving component of the healthcare landscape for well over a decade. This shift away from traditional fee-for-service models aims to improve patient outcomes while simultaneously controlling the exponential costs associated with chronic kidney disease (CKD) and end-stage kidney disease (ESKD).1 While the transition to VBC has its roots in the Accountable Care Organization (ACO) and ESRD Seamless Care Organization (ESCO) models from the early to mid-2010’s, the growth of the market accelerated with founding of dedicated VBC organizations in the late 2010’s the introduction of the ESRD Treatment Choices (ETC) and Kidney Care Choices (KCC) models in the early 2020’s.

Since then the sector has seen substantial financial commitment, with current estimates suggesting an investment exceeding $2.5 billion. This capital has fueled the expansion of VBC models, which now collectively manage the care of over 1 million patient lives and oversee an estimated $20 billion in managed healthcare spend. In response to this growth, VBC providers have established a comprehensive care delivery infrastructure encompassing a complex web of partnerships, economic models, technology integrations for early CKD detection and care coordination, and extensive hands-on patient support systems. These operational networks now cover the majority of the country, utilizing both physical clinic locations and cutting-edge virtual care delivery platforms.

Despite this decade of investment and innovation, significant challenges remain: market penetration and patient engagement. Signals research estimates that currently, only about one-quarter of all diagnosed CKD and ESKD patients are enrolled in a VBC model. Furthermore, even among the patients who are enrolled, questions about the effectiveness of these models persist:

Are patients truly engaged? Enrollment does not automatically equate to active participation.

How responsive are they to VBC interventions? This includes adherence to personalized care plans, medication compliance, and lifestyle modifications.

How responsive are doctors and practices to VBC offerings? This includes provider-level awareness of and engagement with VBC supports.

Are VBC interventions achieving their ultimate goals? The core metrics for success are the tangible improvement in patient clinical outcomes and the demonstrable reduction in overall care costs.

Signals Research Initiative: Quantifying VBC Outcomes

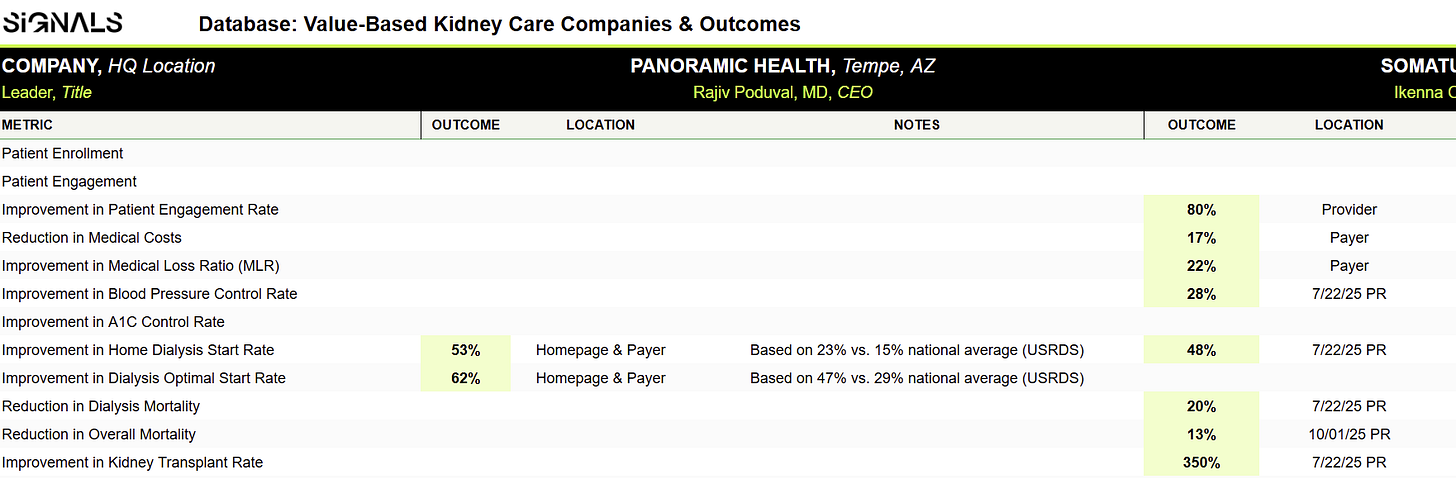

To gain deeper, data-driven insight into the genuine impact of these models, Signals has compiled the publicly available outcomes data from the major VBC competitors in the kidney care space. We gathered this data directly from the VBC provider websites and press releases over the past month.

Our research effort uncovered over 40 distinct outcomes data points spanning 20 different clinical and operational categories. These data points were sourced from 7 of the 10 largest VBC organizations in the U.S., ranked by the number of lives covered.

The majority of the outcomes reported by these providers are directly related to critical patient impacts, indicating a focus on improving the quality of life and clinical trajectory for individuals with CKD. These key reported improvements include:

Dialysis Start Rates: Increases in both overall optimal starts and the use of home dialysis.

Mortality: Improvements and reductions in patient mortality rates.

Transplant Rates: Increases in the number of patients receiving a transplant.

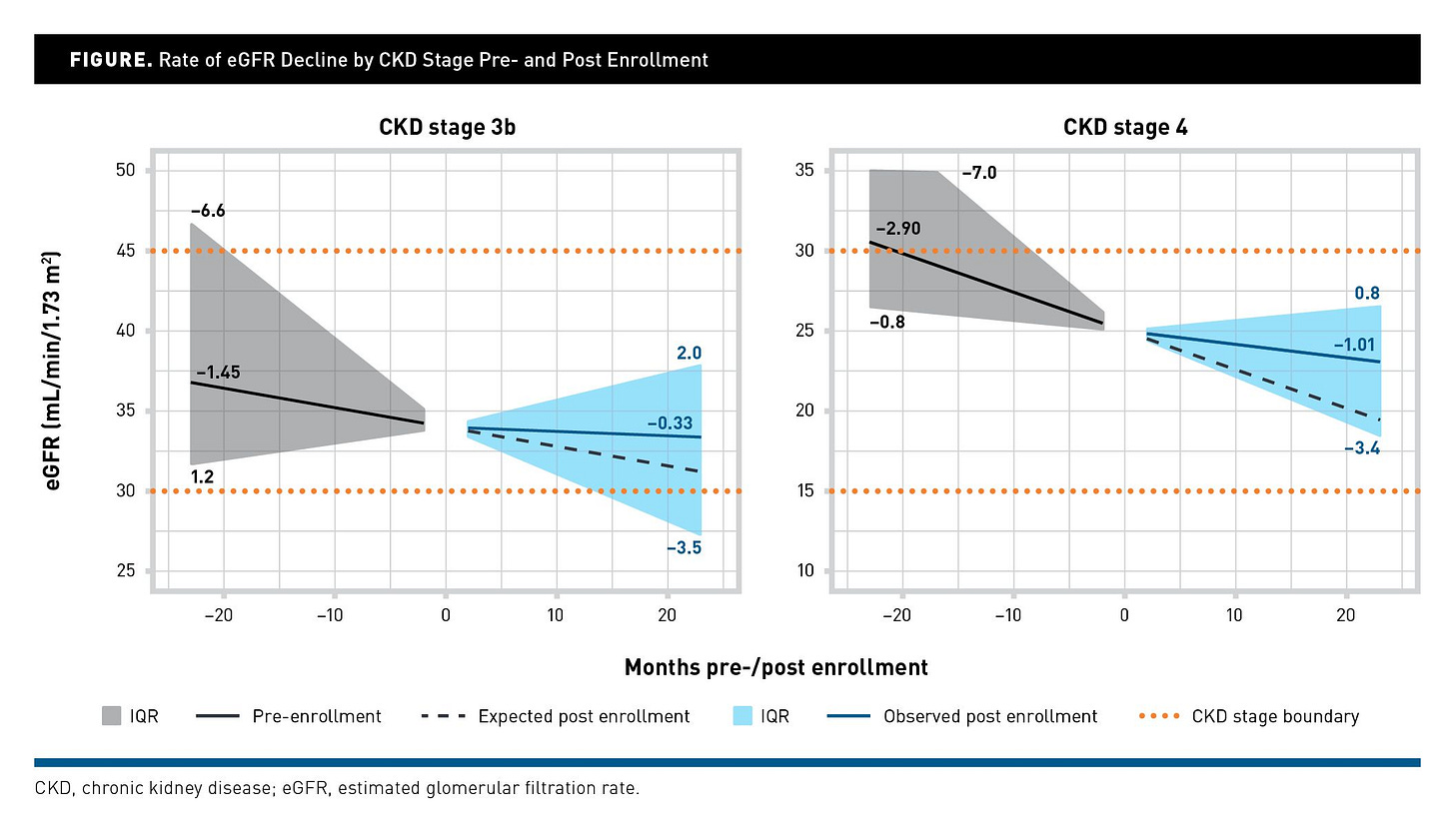

Figure: Rate of eGFR Decline by CKD Stage Pre- and Post Enrollment, AJMC (2025)

While most of the compiled datapoints are derived from internal reporting or observational studies rather than controlled clinical trials, evidence of clinical efficacy is emerging. For example, a recent study published in the American Journal of Managed Care (AJMC) focusing on patients enrolled with one major VBC provider, Strive Health, demonstrated clinical improvements: 77% and 65% reductions in the rate of estimated Glomerular Filtration Rate (eGFR) declines for Stage 3b and Stage 4 CKD patients, respectively. This published data provides a compelling case for the clinical value of proactive, coordinated kidney care models.2

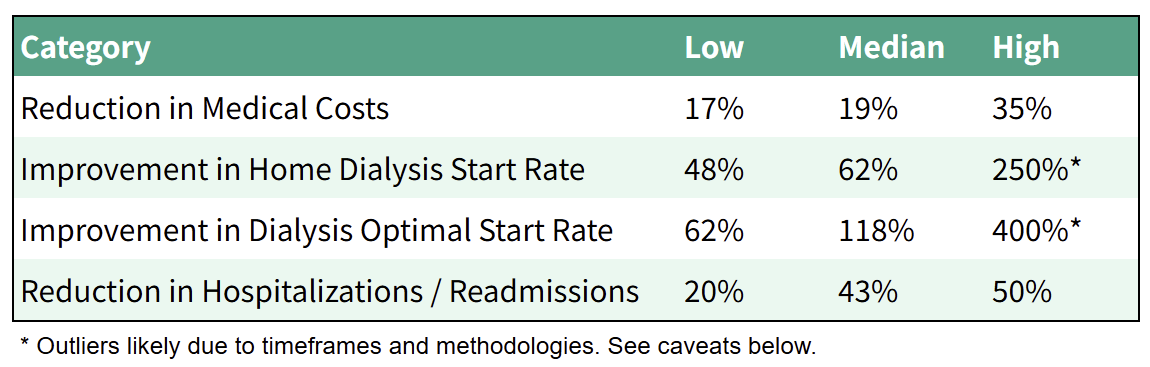

The table below summarizes key outcomes specifically in categories where comparable data points were made publicly available by at least three different VBC providers.

Table: Selected Outcomes

Some providers also highlighted “upstream” metrics that might be viewed as leading indicators or factors that will drive downstream outcomes. Examples in this area include:

Patient Enrollment (63%): Strong enrollment is foundational for VBC programs to at least provide the opportunity for patients to benefit from the array of care services that are offered.

Patient Engagement (93%): This measure likely captures active patient participation in the VBC model (e.g., screenings, medication adherence, using care resources).

Improvement in Blood Pressure Control Rate (28% - 39%): While this outcome has a direct connection to CKD outcomes, its inclusion by several VBCs may also reflect broader ambitions to leverage their model across multiple chronic diseases.

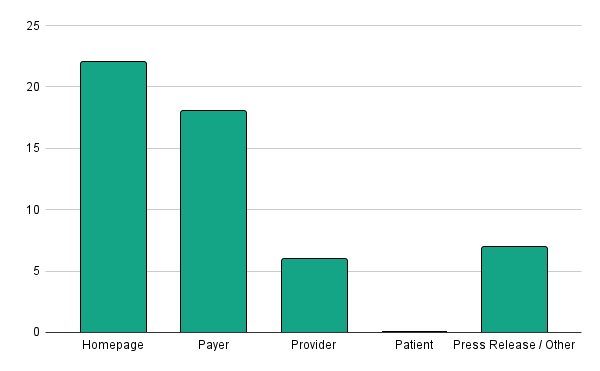

Additionally, economic outcomes are also on display, both directly and indirectly. VBCs shared data on reductions in medical costs (shown above), improvement in medical loss ratio (22%), and partner retention rate (96% - 100%). More subtly, but not surprisingly, most of the outcomes shared were displayed in the payers section of the VBCs website as shown in the chart below. Payers are key beneficiaries of a coordinated care model that drives down the cost of care for kidney patients, particularly by slowing disease progression and reducing costly hospitalizations. We’ve written about Humana’s VB kidney programs and partnership models here.

Figure: Number of Outcomes by Website Section

While it’s notable that metrics were not provided on the patient section of the websites, the verbiage on those pages typically provided qualitative information on how the VBCs services would benefit patients. Future Signals research will review the attributes of different providers’ care models and how they are presented and delivered to patients.

Conclusions & Caveats

Overall, it’s clear that VBCs understand the importance of quantifying the impacts of their products and services on both patients and partners. And, at a glance, those impacts appear to be both positive and meaningful, with more than half of the total data points indicating a 50% or greater improvement in an outcome. Furthermore, the outcomes data are often aligned with and supportive of key payment model metrics in areas such as dialysis start rates and hospital admissions.

But these data should be interpreted cautiously, and it’s premature to compare outcomes in a particular category across VBCs. Websites are primarily for marketing purposes and inherently focus on positive attributes of an organization and its services. Furthermore, the sources, timeframes, and comparison methodologies are inconsistent or unknown. For example, sometimes VBCs drew comparisons of their results to the USRDS, other times to internal datasets. We’ve included sources and notes to describe these ambiguities. We’ve also selectively consolidated categories and normalized some of the data. And where a VBC had multiple different data points for the same metric, we included the most favorable or most recent figure.

Upcoming Signals research on VBCs will cover business and financial metrics (e.g., capital raised, patients enrolled, payer & provider relationships) as well as product offerings (e.g., analytics, AI, patient facing resources, provider tools). If you would like to learn more about our database please fill out this form and/or contact paul@signalsfs.com and tim@signalsfs.com.

Editor’s note (updated): Part 2 of this series, covering business and financial metrics across kidney VBCs, is now available here.

Data Access

Below is a snapshot of our first data release: publicly reported clinical outcomes across leading kidney VBCs. As of December 2025, we’ve released Part 2 and added 300+ datapoints and calculations across key financial and business metrics. Request early access to the full database here.

___

About us

Paul Grill is the Co-Lead of Signals Advisory and a career management consultant, M&A advisor, and venture investor. His most recent role was as Launch Director for the National Kidney Foundation’s Innovation Fund, where he led investments in startups bringing new treatments to kidney patients. Paul is also a living kidney donor and former NKF Board Member who is passionate about improving the lives of kidney patients.

Tim Fitzpatrick is the founder of Signals Group, a media and research platform exploring innovation, investment, and ideas shaping the future of kidney health. Through Signals, he has helped connect thousands of clinicians, entrepreneurs, and investors driving progress across kidney care. Tim previously co-founded IKONA, a learning company using immersive technology to improve patient education and frontline training in kidney care.

Together, Paul and Tim combine deep industry, investment, and advisory experience. From market research and landscape analysis to investment support, financial modeling, and expert feedback, they deliver insights that help companies make confident decisions and accelerate impact in kidney care. Learn more at signalsfs.com

From “Value-Based Care Interventions and Management of CKD Progression”, published in AJMC on October 8, 2025.

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)