It’s been just over a year since I published the original Dialysis Decade piece, and the pace of device innovation in kidney care hasn’t slowed. We’ve seen new FDA clearances, major divestments, and long-fuse areas like renal denervation and organ perfusion start to heat up. Now felt like the right time to revisit this space and share a few signals from the year behind us—and the road ahead.

That first piece covered a lot of ground. This one picks up where we left off, focusing on what happened in 2024 and what it might set in motion in 2025.

By default, medical technology innovation is not fast nor easy. It takes longer, costs more, and happens less often than people think. As I pointed out in part one, most of the companies driving change are Davids, not Goliaths—globally, 80% of medtech firms have fewer than 50 employees (95% in Europe).

One thing that’s come up again and again in conversations with clinicians, advocates, founders, and policymakers: kidney care is different. What was once a miracle of modern engineering—turning kidney failure from a death sentence into something survivable—has, in many ways, gotten stuck. We’ve built an industry on keeping things the way they were in the 1970s.

For years, people have asked: what if that changed? What if policy, protocol, and payment evolved—or innovation finally cracked through? This post is about those glimmers of hope. It’s about what real-world progress looks like, who’s making it, and where it might take us next.

Thank you all for being here, and hope to see you at RPA and NKF this month!

What’s Inside

This Signals audio overview gives you the highlights from my recent device innovation series so you can listen while you work or on the go.1

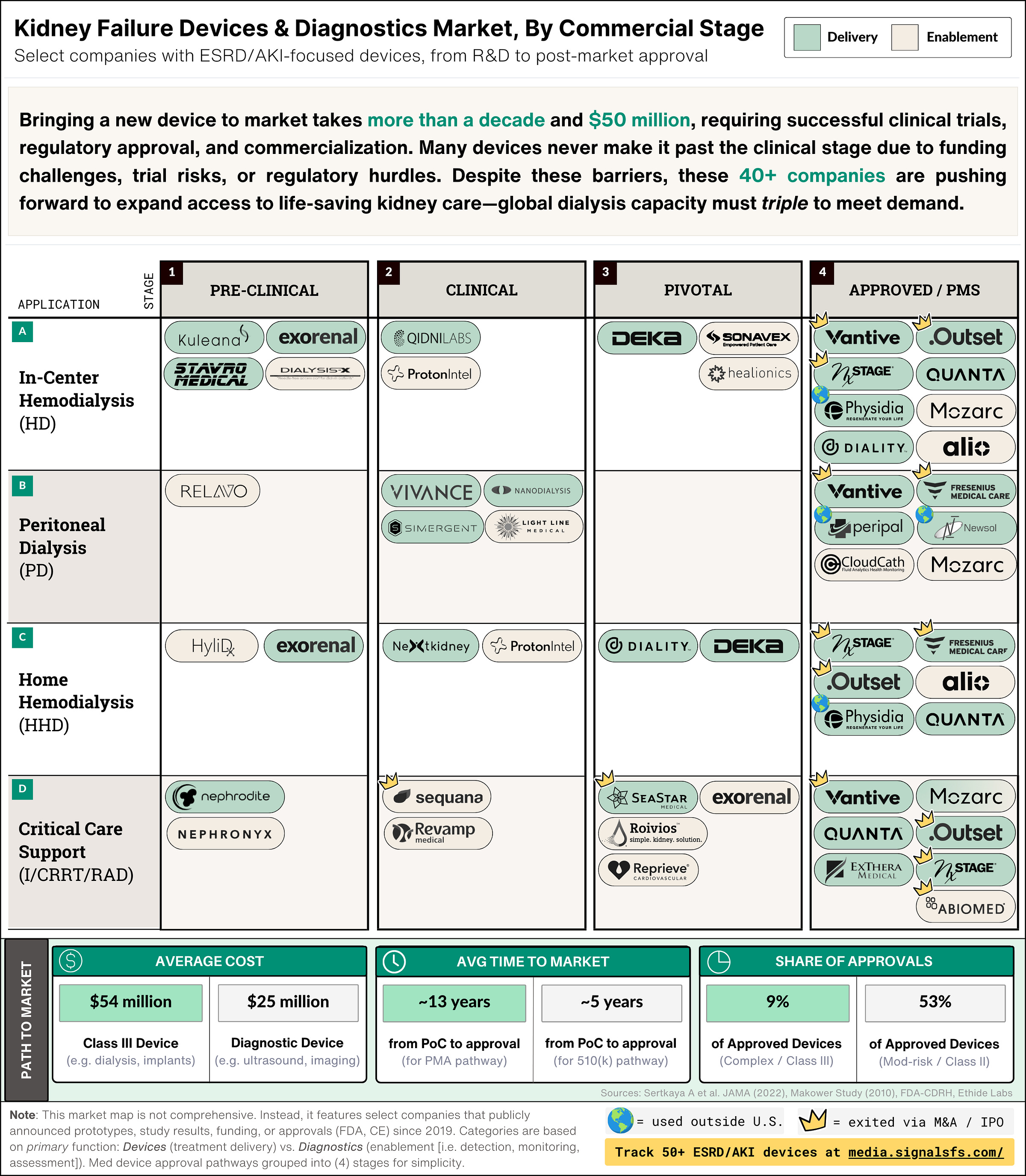

What's in this table:

Stages: The four (4) columns in the table above represent the major milestones device companies face: (a) pre-clinical R&D; (b) feasibility testing; (c) pivotal trials and regulatory submission; and (d) regulatory approval and post-market studies.12

Applications: The four (4) rows represent select dialysis types and care settings: (i) hemodialysis (HD); (ii) peritoneal dialysis (PD); home hemodialysis (HHD); and acute dialysis (I/CRRT).

Device category: The two colors seen in the table represent two broad categories of devices by their primary function. The green items represent devices used in the direct delivery of treatments (i.e. cyclers, machines). The beige items represent devices used to enable treatment (i.e. detection, monitoring, assessment).3

Paths to market: The summary tables are set against the yellow background. They contain data that aims to highlight broader industry averages for medical devices. There are three summary tables: (i) development cost; (ii) time to market; and (iii) share of FDA approvals. Each table displays average data for two device types: Class III devices on the left, and Diagnostic devices on the right.

Labels: There are two additional labels to note. First, I’ve once again included a crown (“👑”) for companies with an exit, either through M&A or IPO. Second, I’ve added a globe (“🌍”) where devices are in use and approved, but outside the US (e.g. CE, PMDA).

2025 Updates

1. Peripheral Tech: The Enabling Layer of Dialysis Innovation

Peripheral technologies are quietly reshaping kidney care by enhancing the performance of traditional dialysis machines and expanding what’s possible across care settings. These tools—ranging from vascular access and fluid monitoring to safety and connectivity—are often built on faster-moving 510(k) pathways, allowing for quicker development and adoption. Instead of reinventing the machine, these innovations improve how and where treatment happens, making dialysis more patient-friendly, efficient, and adaptable.

This enabling layer is essential—not just for the future of home dialysis, but for rethinking how available treatment options are delivered in facilities, too.

Key Points:

Accelerated Development: In many cases, peripheral devices typically follow 510(k) clearance, allowing for shorter development cycles and lower capital requirements compared to their Class III counterparts (…but keep reading for the surprising, hard truth about time-to-exit).

Enhanced Patient Experience: These innovations improve safety, monitoring, and ease of use, directly benefiting patient care. Whether it’s Alio’s SmartPatch, CloudCath’s Connect, or Relavo’s PeritoneX, add-ons can make a big impact.

Operational Efficiency: By streamlining tasks like vascular access and remote monitoring, peripheral tech can ease staffing burdens and support broader modality adoption. New protocols will be needed—but they’re within reach.

Complementary Innovation: These technologies don’t replace dialysis machines—they make them better. Forward-looking manufacturers would be smart to partner early. Every company mentioned here shares a common purpose: making life-sustaining treatment safer, more accessible, and more human.

2. Clearance ≠ Growth: What’s Next After FDA Approval?

New FDA clearances continue to shape the home dialysis landscape—but adoption isn’t guaranteed. Companies like Quanta and Diality have hit key regulatory milestones since our last post, yet we’re still years away from understanding how broader device availability will affect real-world access or patient choice. Home dialysis remains largely tethered to in-center-first infrastructure, with no clear disruptor operating a dedicated home-only model.

The early end of the ETC model and persistent gaps in critical infrastructures raise the pressing question: Will a dedicated, home-first dialysis provider emerge in the years ahead? Either way, the disconnect makes one thing clear: regulatory approval is only step one. Scaling home dialysis requires coordinated execution and system-wide support.

Key Points:

Regulatory Success ≠ Market Adoption: FDA clearance is just the beginning. Companies must build a strong post-approval roadmap—securing market access, scaling regulatory and medical affairs, engaging clinical partners, and demonstrating real-world value. This applies to U.S.-based devices and those entering from CE or other international markets, where many face similar systemic hurdles.

Infrastructure and Policy Still Lag: The discontinuation of the ETC model, combined with inadequate staffing, billing, and training frameworks, restricts the effective rollout of home HD programs. The proposed home dialysis bill aims to address these issues by mandating comprehensive patient education on all dialysis options, expanding the pool of providers who can deliver training through group sessions, telehealth, and off-site methods, and covering in-home support costs to help patients transition safely from facilities to independent home care.2

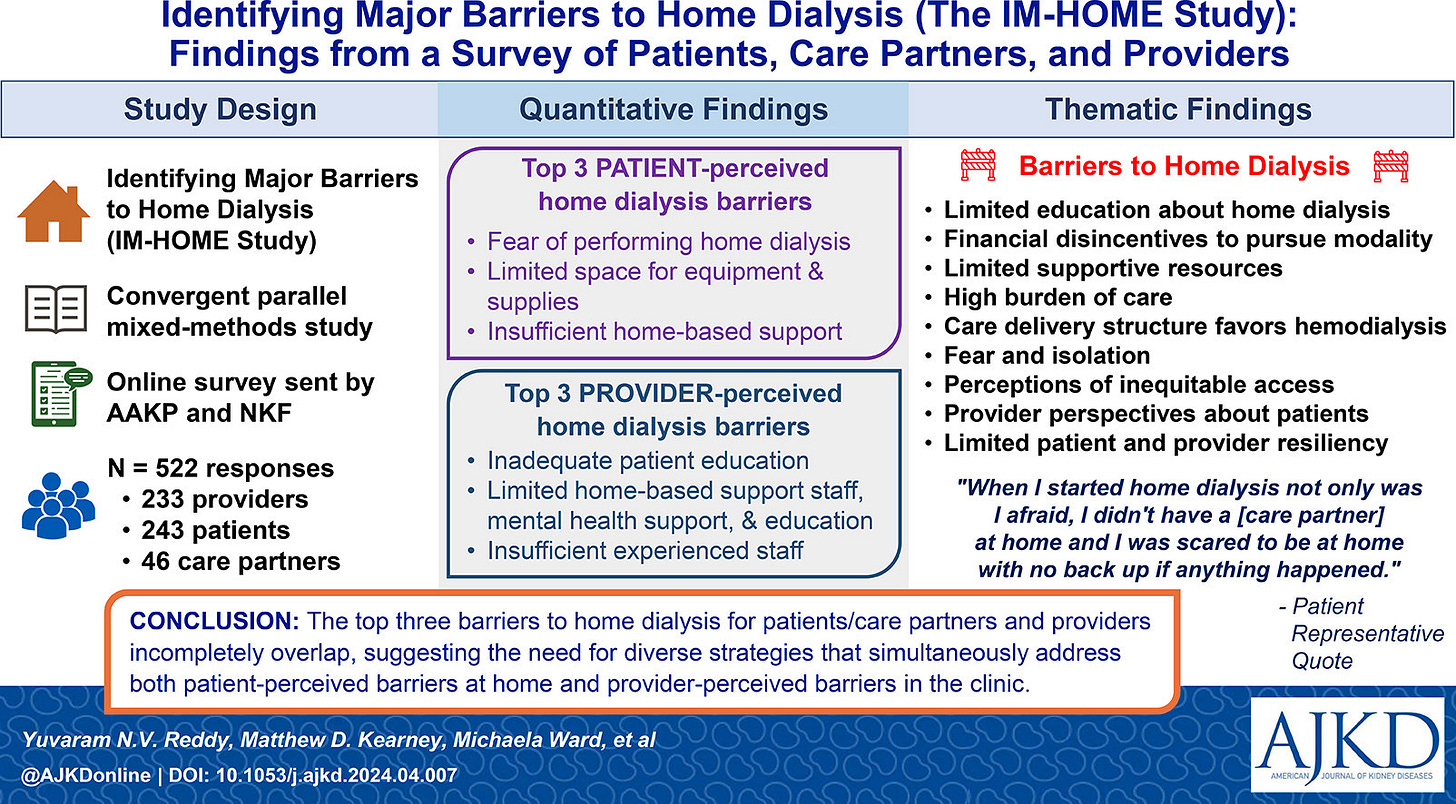

Low Uptake, Even as Options Expand: Home HD still accounts for under 3% of all dialysis. PD grew 70% from 2012–2022, especially in rural and less socioeconomically deprived areas, but overall access has stagnated. In 2022, 46.6% of dialysis facilities (3,798 clinics) weren’t certified to offer home modalities—and even certified programs often lack active patients.

Barriers That MUST Be Addressed: Progress requires removing key bottlenecks: certifying more facilities, training providers, and enabling nephrologists to play a bigger role (only 4% of PD catheters were placed by nephrologists in 2022—the highest rate in a decade). Meanwhile, Fresenius’ upcoming U.S. launch of its HDF platform in 2025 could reset expectations for adequacy and fluid management in-center, reigniting conversations about what modern dialysis should deliver.3

3. MedTech Capital & M&A Trends: Who’s Investing Where?

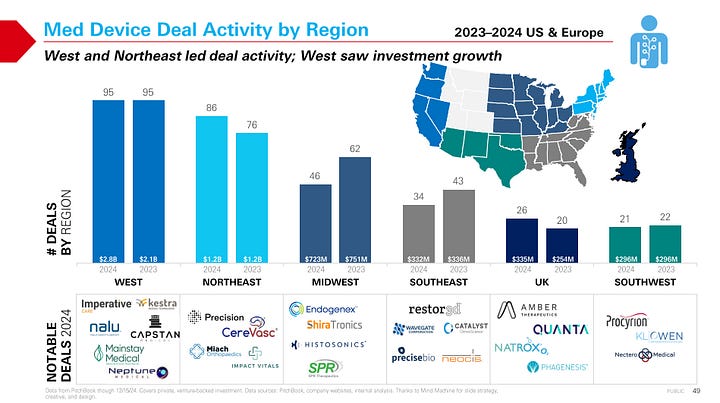

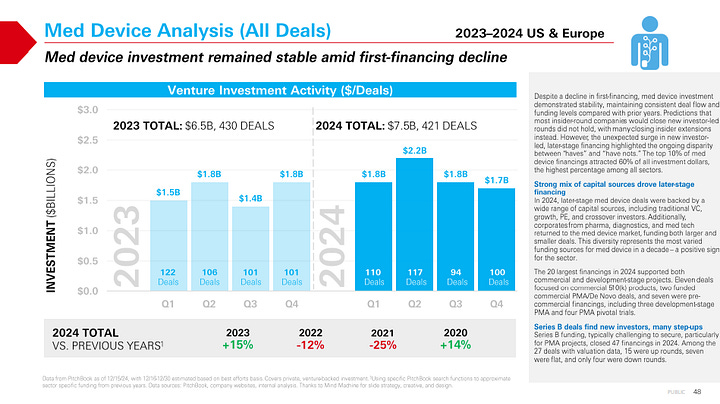

Private capital is consolidating around fewer, larger bets—and M&A timelines are stretching, posing both challenges and opportunities for dialysis and extracorporeal innovators. In 2024, the top 10% of medtech financings captured 60% of all investment dollars, highlighting a more selective environment that favors scale, momentum, or late-stage readiness.

Sectors like vascular, cardiovascular, and uro/gyn saw the biggest gains in deal activity. In kidney care, Getinge’s $477M acquisition of Paragonix signaled continued interest in transplant-adjacent technologies. And J&J’s $1.7B purchase of V-Wave, which makes a minimally invasive shunt for heart failure, reflects the growing relevance of cross-organ, chronic care platforms—especially in high-acuity or multi-morbidity settings.4

Key Points:

Selective Investment Climate: In 2024, just 10% of med device financings captured 60% of the dollars. Vascular saw five $50M+ deals—two for commercial-stage 510(k) products and three in clinical trials—while cardiovascular remained stable year-over-year with seven $40M+ deals.

Cardio & Renal Investing: Cardiovascular investing remained stable compared to 2023, but still 15–20% below 2020–2022 levels. Of the seven large deals, four were in development or feasibility trials, reflecting investor willingness to bet on platform potential.5

Concerns Over Exit Timelines: The median time to exit for venture-backed medtech companies hit 11.9 years in 2024—more than double the 5.8-year median in 2021. This extended timeline has impacted first financings, with a notable decline across devices.

Pathway Matters: 510(k) vs. PMA: All 17 venture-backed 510(k) exits over the past three years involved FDA-cleared, revenue-generating products. In contrast, PMA-focused companies often exit pre-approval, based on pivotal data and market size potential. While some regulatory pathways may seem faster or less costly upfront, they often require more time to build scale and revenue traction—potentially delaying exit compared to PMA peers. In today’s slower IPO and M&A market, financing strategy and exit optionality are more important than ever.6

Strategics Are Repositioning: In August, Baxter sold its 70-year legacy kidney care business to private equity for $3.8B, spinning it out as Vantive. The deal reshaped one of the largest dialysis players and reflects a broader trend of capital reallocation—where legacy firms focus elsewhere while investors double down on standalone kidney platforms.

4. Renal Denervation: The Long Game, Back in Play

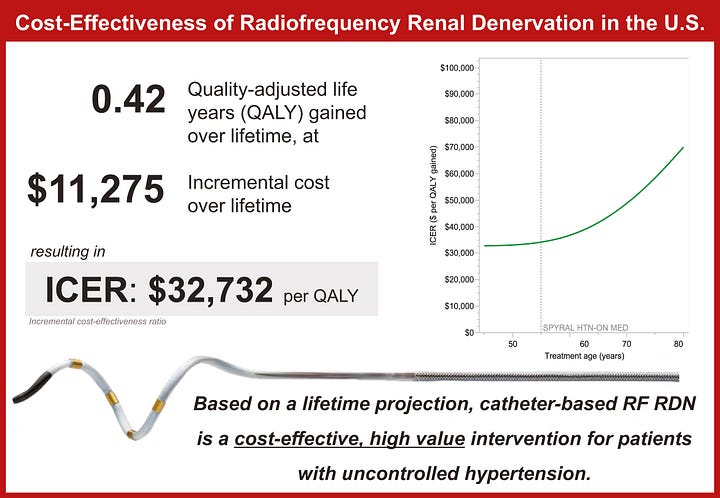

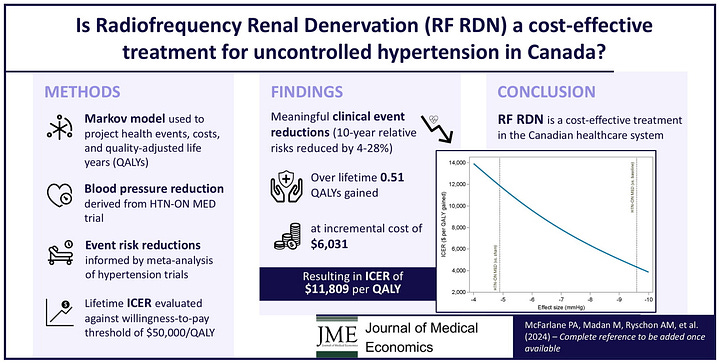

After more than a decade of clinical twists and strategic resets, renal denervation (RDN) is gaining traction. With FDA approvals for Medtronic and Recor Medical in late 2023 and new CMS payment pathways potentially opening in 2025-2026, the therapy is finally getting real traction in both clinical and policy circles. The Centers for Medicare & Medicaid Services (CMS) granted transitional pass-through (TPT) payment for both systems as of January 1, 2025, and has launched a national coverage analysis (NCA) with a final decision expected by October.

Recent trial data is compelling, and analysts expect the market to grow at a 22% CAGR, reaching $128.7M by 2028. But questions around reimbursement, provider adoption, and patient access remain. RDN may well become the latest test case for how long device innovation can wait for system alignment.7

Key Points:

Real-World Data Matches Trials: Dr. Jeremy Bock’s team presented one of the largest U.S. commercial RDN cohorts to date. Their results showed significant, sustained blood pressure reductions—mirroring the outcomes seen in randomized trials and meta-analyses.8

FDA Approvals Are In: Medtronic’s Symplicity Spyral (radiofrequency) and Recor’s Paradise system (ultrasound) both received FDA approval in late 2023. Medtronic has signaled plans to explore multi-organ denervation, including the liver and kidneys, with its Symplicity platform.

High Need, High Potential: More than one billion adults worldwide live with hypertension—most in low- and middle-income countries—and just 1 in 5 have it under control. Many are either living with or at risk for kidney failure, making RDN highly relevant to the ESKD and AKI communities.

Market Momentum, but Payment Lag: RDN ranks #3 among 200+ device categories tracked by LSI for growth potential. But adoption is still constrained by the lack of national Medicare reimbursement. While TPT payments are in place, broader payer support will be essential to move beyond early access.

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!NnOt!,w_144,h_144,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F688fc47b-7202-4a2e-b4f4-fea2b047ab1b_1500x1500.png)