Home dialysis is a promising option for many patients with kidney disease, but barriers persist in adoption. In July, I wrote about hurdles highlighted in the IM-HOME study, including limited patient education and provider awareness, lack of support from healthcare systems, and logistical barriers like training and equipment access to name a few. These barriers prevent more patients from choosing home dialysis, despite its benefits for improving quality of life and outcomes.1

No two patient journeys are the same. As much time as we spend talking about how big of a problem kidney disease is in this country, and for good reason, the reality is our current built-for-scale kidney care system misses the trees for the forest. Doing a complex, live-sustaining treatment “on your own'“ at home is scary. But how does someone get from “I need dialysis” to “I can do dialysis at home?”

…the top 3 barriers cited by patients and caregivers included fear of performing dialysis at home, lack of space, and the need for home-based support. On the other hand, providers identified poor patient education, limited support staff, and lack of experienced staff as the primary obstacles.

Measuring Progress

The latest USRDS report contains data from FFS claims through 2022 and Medicare Advantage (MA) data through 2021. In some cases, it even contains ESRD metrics through 2023. Together, these annual reports give us a sense of how we’re doing across the kidney ecosystem, from CKD to ESKD, leveraging a range of datasets and partner resources spanning NIH, CMS, OPTN, the ESRD networks, and more.

Today, I thought I’d share a few observations, takeaways, and questions with all of you after reading through the home dialysis chapter— and invite you to weigh-in and share your personal perspectives, reflections, and hopes.

Here are a few thoughts, in no particular order.

Observations

1. Home Dialysis Use Continues Its Uphill Climb in the U.S.

From 2012 to 2022, the percentage of incident ESRD patients using home dialysis grew by over 70%, from 8.5% to 14.5%. This growth, primarily driven by peritoneal dialysis (PD), slowed slightly during periods of PD solution shortages (mid-decade) and the COVID-19 pandemic. Several factors influence home dialysis adoption, including age, race, primary cause of ESRD, and neighborhood social deprivation index, or SDI.

Pro tip: you can toggle most figures in the ADR to see how each of these factors impacts growth across home modalities.Key Points:

70% increase in home dialysis use among incident ESRD patients from 2012 to 2022, with PD as the primary contributor to this growth.

42% increase in home dialysis use among prevalent ESRD patients, with PD rising from 8.8% to 12.1% and home HD from 1.5% to 2.4% over the same time period.

Home dialysis is more common in rural areas and among individuals living in less socioeconomically deprived neighborhoods.2 There are two great figures in the report showing PD use by HSA (Fig 2.3a) and HHD use by state (2.3b) that help drive this point home.

ETC model impact: Markets assigned to the ESRD Treatment Choices (ETC) model showed higher adoption of home dialysis in 2022 and 2023, compared to non-ETC markets (see Fig 2.2).

Racial and ethnic disparities: White and Asian individuals have higher rates of home dialysis use compared to Black and Hispanic populations, especially for PD.

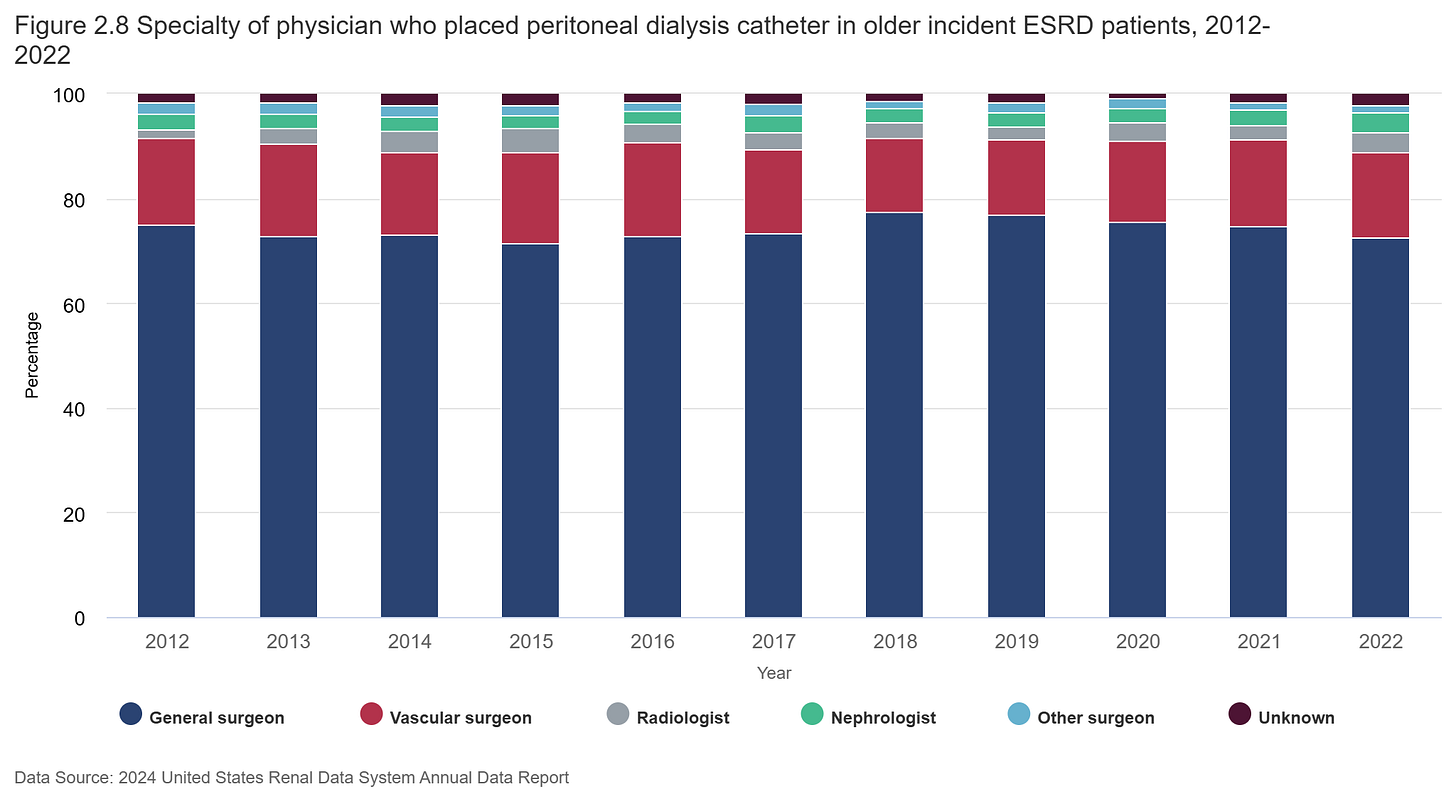

2. Nephrologists Placed 4% of Peritoneal Dialysis Catheters in 2022, the Most They’ve Done in a Decade

In order to expand the use of peritoneal dialysis (PD), having proficient operators who can place PD access is crucial. According to the 2024 ADR, nephrologists placed just 4% of PD catheters in 2022, while the vast majority (89%) were placed by general surgeons (72.5%) and vascular surgeons (16.4%). While the distribution of physician specialties for PD catheter placement has remained fairly consistent over time, there has been a slight increase in the involvement of radiologists. As PD continues to grow, ensuring that nephrologists are more involved in this aspect of care will be an important step in improving accessibility and quality of treatment.3

Key Points:

General surgeons place 72.5% of PD catheters, while nephrologists placed only 3.9% in 2022. That ratio has largely held constant for a decade; though, 2022 was the highest share of placements done by nephrologists in that time period (9 out of 10 years were in the 2-s).

Radiologists and vascular surgeons play a significant role here, with radiologists placing a similar amount to nephrologists (3.8%) and vascular surgeons responsible for the second-most at 16.4%.

An uptick for nephrology? If PD represents the go-to growth lever for home, and nephrologists seem to be doing more of these procedures, what do you expect to see for 2023-present? Is the access field changing, and if so how?

3. The Number of Facilities Offering Home Dialysis is Increasing; So Are Programs Without Active Home Patients

The report opens with this salient point: growing home dialysis requires adequate infrastructure and human capital. Dialysis facilities must be certified to offer—and deliver—home dialysis. Between 2017 and 2021, the number of dialysis facilities grew by 10%, while the number offering home dialysis grew by 9%. However, despite these increases, the proportion of facilities offering home dialysis remained relatively unchanged. A small but steady rise in certified facilities without active patients is noteworthy. Additionally, more facilities offer peritoneal dialysis (PD) than home hemodialysis (HD), with similar proportions of each type certified without active patients.

Key Points:

10% growth in total dialysis facilities from 2017-2021, paired with a 9% increase in facilities with active home dialysis patients. Essentially unchanged in 2022.

3% growth in certified facilities without active home dialysis patients. That’s from 897 facilities in 2017 to 924 facilities in 2022.

Very little change in the distribution of facilities in each category: 46.6% of facilities (3,798 clinics) were not certified to offer home dialysis in 2022.

40.1% of facilities offered peritoneal dialysis (PD), while 17.3% offered home HD. The percentages of certified facilities without active patients were similar for PD (11.5%) and home HD (11.9%).

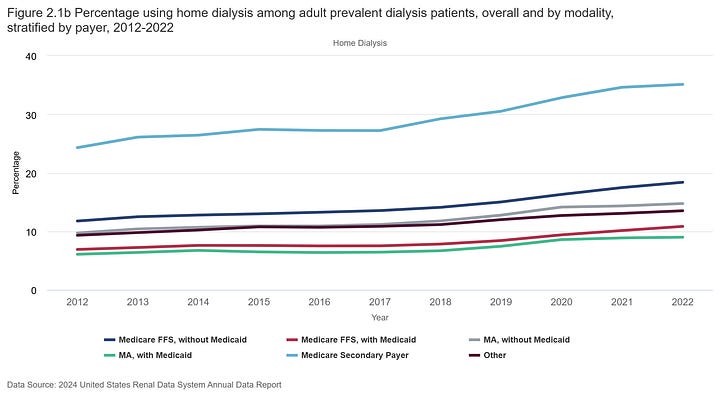

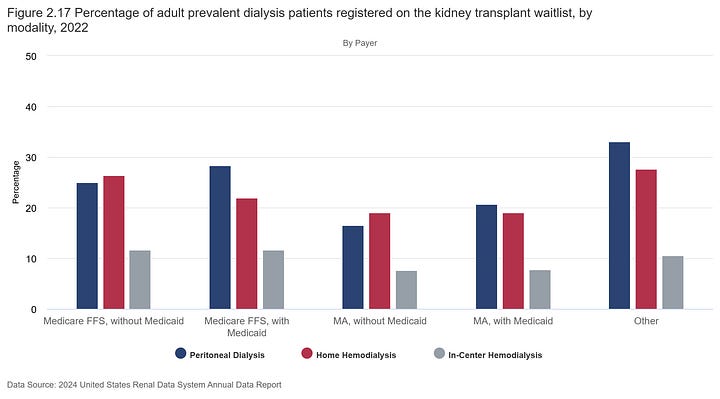

4. Payer Matters: Insurance Impacts Outcomes Across Care Settings and Modalities, Especially Among MSPs

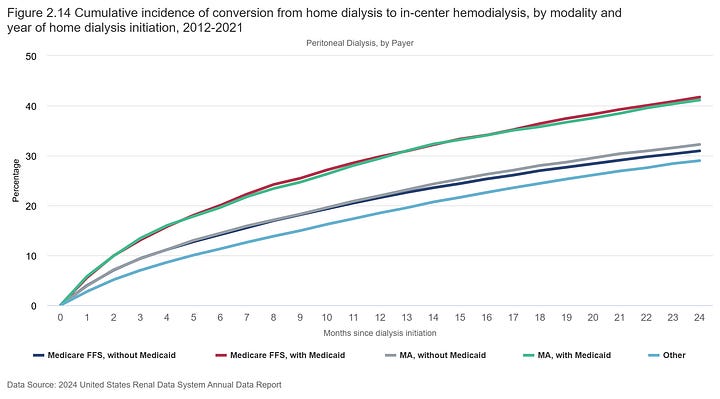

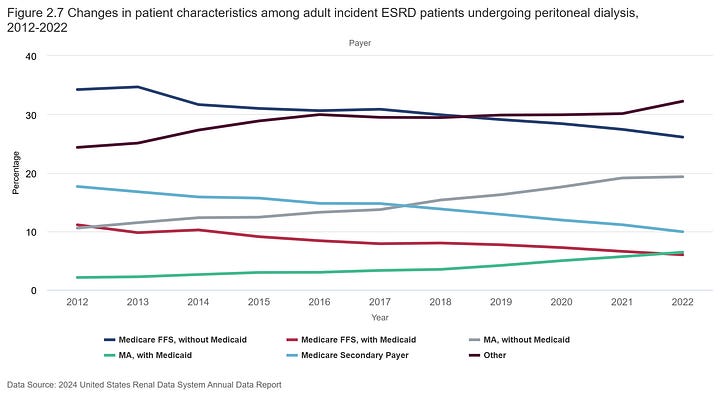

The 2024 ADR introduces payer types as a stratification for dialysis trends in several figures. The four figures below highlight key differences in access to all ESRD treatment modalities—home dialysis (PD and Home HD), conversions from home dialysis to in-center, and transplant waitlisting—by insurance coverage.

Key Points:

Home dialysis use is highest among Medicare secondary payers. In 2022, 35% of Medicare secondary payer (MSP) patients used home dialysis (30.2% on PD and 4.9% on home HD), nearly four times the rate of Medicare Advantage (MA) with Medicaid, where only 9% used home dialysis.

Conversions from home to in-center dialysis are more common among dual-eligible individuals. 41% of those with FFS plus Medicaid transitioned to in-center, compared to 32% with MA alone. At the two-year mark, nearly half (49.5%) of individuals with MA plus Medicaid transitioned to in-center, which was far higher than individuals with other insurances (<40%).

Transplant waitlisting rates differ by payer. Lower percentages of individuals with MA were listed relative to individuals with Medicare across all dialysis modalities. I’ll be curious to see how this squares with the increases in active waitlisting seen among KCC participants in the recent PY22 outcomes report— will we see an uptick in transplants in future ADRs?

Presence of Medicaid (whether FFS or MA) was associated with higher transplant listing percentages among in-center HD and PD patients, but the opposite was true for home HD.

Resources & Data

Ready to keep exploring this topic? Below are several resources worth exploring to expand your breadth and depth of knowledge, and the data to support them.

We should probably talk about (barriers to) home dialysis. My previous piece explores ways the IM-HOME study reshapes our approach to patient, care partner, and provider-facing barriers to home dialysis.

Starting the dialysis conversation: Zach Miller wrote an incredible 7-Part series on the business of kidney care in the United States. Part 4 unpacks the operations, clinical, and business considerations of home dialysis before Part 5, which goes deeper into how we can increase that 14%. This is a must-read if you work in clinic operations, value-based care, or, frankly, anywhere in CKD or ESKD.

Home Dialysis Bill: Last April we wrote about the home dialysis bill that would provide funding for staff assistance, plus more training options for home dialysis. The Improving Access to Home Dialysis Act (HR-8075) was introduced on April 18 in the U.S. House of Representatives. If passed, the law will mandate that patients get proper education on all of their dialysis options, expand the universe of healthcare providers who can provide home dialysis training, and cover the costs of in-home staff support when they’re beginning that critical phase of their journeys.4

Medicare Secondary Payer ESRD Introduction. The MSP provisions of the Social Security Act require Group Health Plans (GHPs) to make payments

before Medicare under certain circumstances. This CMS presentation provides helpful background and guidelines for understanding how it works. It’s worth noting considering the timing of insurance-related policy measures currently on the docket on Capitol Hill and recently put before the Supreme Court in Marietta v. DaVita.

USRDS Home Dialysis: The most recent Annual Data Report includes a section on Home Dialysis in adults. Bookmark this ADR if you work in this space — it is the closest thing to a benchmark we have available when comparing outcomes across providers and care models.

VR Education & Training: I believe several of these obstacles can be overcome by leveraging the power of immersive technologies like virtual and augmented reality to deliver effective, consistent, on-demand, hands-on education and training experiences for patients, care partners, and frontline staff. We have written extensively about these opportunities (here, here, here, here, here, and here).

Discussion

Here are a few insights and perspective from around the community on this topic. Share Signals with your network and peers, we’d love to hear what’s on your mind:

Barriers: What do you think are the most significant barriers to increasing home dialysis adoption, and how can we address them at the provider, patient, and healthcare system levels?

Nephrologists: How do you see the role of nephrologists evolving in the growing use of peritoneal dialysis (PD), especially in light of the 4% of PD catheters placed by nephrologists in 2022? What would it take for nephrologists to play a more central role?

Disparities: What are your thoughts on the disparities in home dialysis use across different racial/ethnic groups? How can the industry better support underserved populations when it comes to improving access to home dialysis? What examples have you seen work well?

Payers: How do payer types (e.g., Medicare Secondary Payer vs. Medicare Advantage) influence ESRD treatment choices and outcomes? What changes could be made to improve equity in access to home dialysis? What should we know or have on our radars with the evolving MSP and MA landscapes?

ETC: With the growth of the ESRD Treatment Choices (ETC) model, do you think mandatory participation in home dialysis programs will drive significant change in patient outcomes? Why or why not?

Reddy YNV, Kearney MD, Ward M, Burke RE, O'Hare AM, Reese PP, Lane-Fall MB; IM-HOME Advisory Board. Identifying Major Barriers to Home Dialysis (The IM-HOME Study): Findings From a National Survey of Patients, Care Partners, and Providers. Am J Kidney Dis. 2024 Nov;84(5):567-581.e1. doi: 10.1053/j.ajkd.2024.04.007. Epub 2024 Jun 6. PMID: 38851446.

Learn more about the Social Deprivation Index (SDI) — Robert Graham Center

Dialysis vascular access is an area we will spend a lot more time exploring in 2025 thanks to several advocates, researchers, clinicians and companies I’ve heard from over the past year. If you have suggested reading, reports, or KOL interviews we should consider for the Signals audience, please do not hesitate to reach out.

What should we keep in mind here, especially given the new administration, 119th Congress, and “kidney-friendly” leadership at CMMI? Share any comments below or join the in-depth conversations happening in Slack.

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!IXc-!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9f7142a0-6602-495d-ab65-0e4c98cc67d4_450x450.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!lBsj!,e_trim:10:white/e_trim:10:transparent/h_48,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0e0f61bc-e3f5-4f03-9c6e-5ca5da1fa095_1848x352.png)

![Signals From [Space]](https://substackcdn.com/image/fetch/$s_!NnOt!,w_144,h_144,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F688fc47b-7202-4a2e-b4f4-fea2b047ab1b_1500x1500.png)